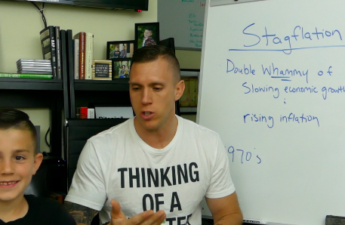

Throughout the Whiteboard Series and Week In Review videos, we’ve spent time discussing The Federal Reserve and its efforts to manage inflation. As we see inflation beginning to rise, you might begin to hear people talk about stagflation. It’s been a long time since the U.S. has experienced stagflation–most of you probably weren’t alive when it ran rampant in the…

Category: Whiteboard Series

Whiteboard Series: Control What You Can Control

In financial planning there are really only a few variables that individuals actually have control over; interestingly enough, it’s the other variables (out of our control) that attract the majority of the attention. In this episode of the Whiteboard Series, Leo joins me to discuss why you should focus on what you can control and what areas of your financial…

Whiteboard Series: Backdoor Roth IRA

As many Millennials begin to see their incomes rise, they are beginning to the phaseout of being able to contribute to one of the most powerful investment vehicles around–the Roth IRA. I’m surprised how few people are aware of the backdoor Roth IRA strategy which until the most recent tax bill was technically a loophole. But it now has received…

Whiteboard Series: Consumer Price Index (CPI)

It’s spring break and the boys, well two of them, decided to join me for a new Whiteboard Series video. We’ve been hearing a lot about the Federal Reserve raising interest rates to keep inflation in line; the last Whiteboard Series video covered what is meant by a hawkish and dovish Fed. Today, Roman and Leo help me explain another…

Whiteboard Series: Hawks vs. Doves

If you tuned into last week’s Week In Review you might remember me using the terms “hawkish” and “dovish” when discussing Federal Reserve Chairman Jay Powell’s testimony before Congress. While these terms are not new to anyone working in finance or closely follow the Federal Reserve (not sure how many people fall into this category), they are probably new to…

Whiteboard Series: CAPE Ratio

We had a snow day today, so Roman, Leo and I made a special trip to the office to record today’s Whiteboard Series video; I’ve been busy getting the podcast up and running that the Whiteboard Series was put on the backburner, but it’s back now. This Whiteboard’s topic, the CAPE ratio may not be a familiar metric for most,…

Whiteboard Series: Factor Investing

It’s no secret investment management and research is my favorite part of the execution of a financial plan. Prior to starting RL Wealth Management, I would research different strategies and read what the best money managers would write, but I was never in a position where I could use my research in my clients’ portfolios. That all changed in July…

Whiteboard Series: Beneficiaries

Beneficiary designations are one of the most overlooked parts of a financial plan; it’s a small section of an IRA application, 401(k) enrollment, or life insurance policy, but it is extremely powerful and important. Watch the video below to learn more about beneficiary designations, when you remember to update them, and how beneficiary designations are often forgotten about. Enjoy Leo’s…

Whiteboard Series: Market Corrections

There’s been plenty of conversation about a stock market correction in the financial media as of late, and rightfully so–it’s been awhile since we’ve had a correction, North Korea’s shenanigans, hurricanes, wild fires and D.C. are all good reasons for a market correction. In today’s episode, Leo and I talk about what a market correction is, how often they occur,…

Whiteboard Series: 401(k)s

It’s pretty safe to assume most people are familiar with 401(k) plans–the retirement savings plan offered by many companies. While saving into a 401(k) is a great habit, there may be more efficient ways to save for retirement above the amount needed to receive the company match. Check out the video below to learn about different components of your 401(k)…