Academic research suggests the foundation for a long term investment strategy is a globally diversified portfolio; statistics show the average investor is holding a domestically diversified portfolio. If the evidence from academic research is so strong, what is the disconnect between the evidence and investor behavior?

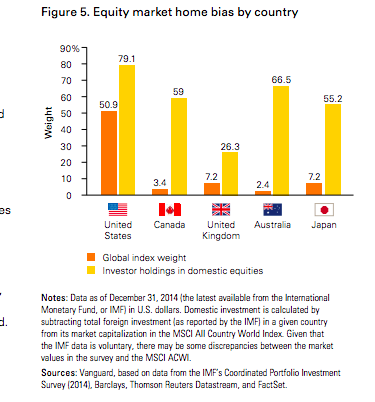

Most investors suffer from a bias towards investing domestically; in the industry, we call this having a home country bias. Investors across the globe suffer from this bias–it’s not just a US investor dilemma. A study conducted by Vanguard revealed that investors in the US, Canada, the UK, Australia and Japan all exhibit a strong bias towards investing in their domestic markets. The chart below shows a comparison of each countries allocation in the Global Market Index and the corresponding investor allocation to their home country.

Why do investors suffer from home country bias?

Familiarity. Peter Lynch, an extremely successful fund manager encouraged investors to invest in what they know. Investors know their home country better than foreign countries, which results in greater confidence investing domestically.

Access to Information. With Google accessible pretty much anywhere, information is always at our fingertips. However, it is not as easy to find information on foreign companies as it is companies in your own backyard. Yes, you can pull up the financials of any global company relatively easily; however, intangible information is not as easy to get across the globe. Employee morale doesn’t show up on an annual report; however, having a family member working for a domestic company can provide an insight to the health of a company. Because of this, investors feel more confident sticking to companies close to home.

401(k) matches and Employee Stock Purchase Plans. While 401(k) matches in company stock and employee stock purchase plans are most likely minor contributors to home bias, they do lead to a domestic overweight in some investors’ portfolios. This lends itself to a topic for another day…how much is too much company stock to hold?

Reliance on Multinational Domestic Companies. Investors tend to rely on domestic companies with an international presence (which is pretty much every company in today’s world) to provide their exposure to global markets. And while multinational domestic companies do provide exposure to international markets, it is not the same as investing directly into those markets. It is a false sense of global diversification.

Other Incentives. Australians can actually receive tax incentives for investing in local companies.

Geopolitical Risks. Government and currency risks are two of the major geopolitical risks that prevent investors from allocating to foreign markets. While these are risks investors need to be aware of, they are also the same risks that provide the long term returns associated with international marketing. In investing, investors are rewarded for the risks they take; the key is being able to stomach the risk and hold long term. While all of the risks need to be considered when constructing a portfolio, continuing to exhibit a home country bias may lead to a drag on portfolios.

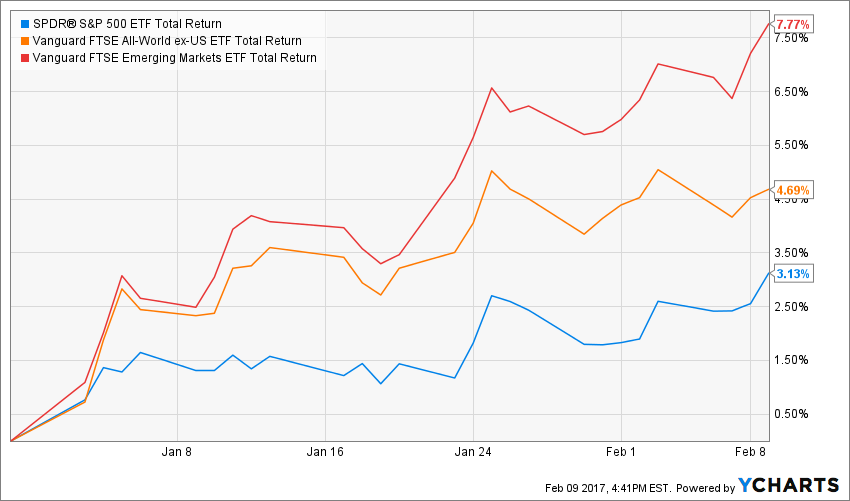

US investors have benefited from their home country bias in recent years, but this won’t last forever. As you can see below, over the last five years the domestic US market has significantly out performed international markets, represented by the Vanguard FTSE All-World ex-US ETF (VEU) and the Vanguard FTSE Emerging Markets ETF (VWO). How much longer will this last?

Eventually, the US market will become overvalued relative to international markets, and investors will shift their attention to international markets, which will allow them to play catch up. The trouble is, it is impossible to know when this will occur. The current P/E ratios of SPY, VEU and VWO show the US domestic market is trading at a premium to the international markets; it can be argued that the US market is a better market to be in, and the higher P/E ratio is deserved. While this is true, eventually the higher P/E ratio will become less attractive, and the lower P/E ratios of the international markets will provide a better value to investors.

Note: I am not suggesting investors make decisions solely on the basis of P/E ratios. There are other factors to consider when investing, but looking at P/E ratios is one way to evaluate value in different markets.

Although it is early in year, it appears the tides may be turning. The chart below shows the total return year to date for the same ETFs we looked at earlier, and while they are all up, the international markets are doing a little better. Will this continue?

Before you make drastic changes to your portfolio, consult your financial advisor to determine the appropriate amount of international exposure.

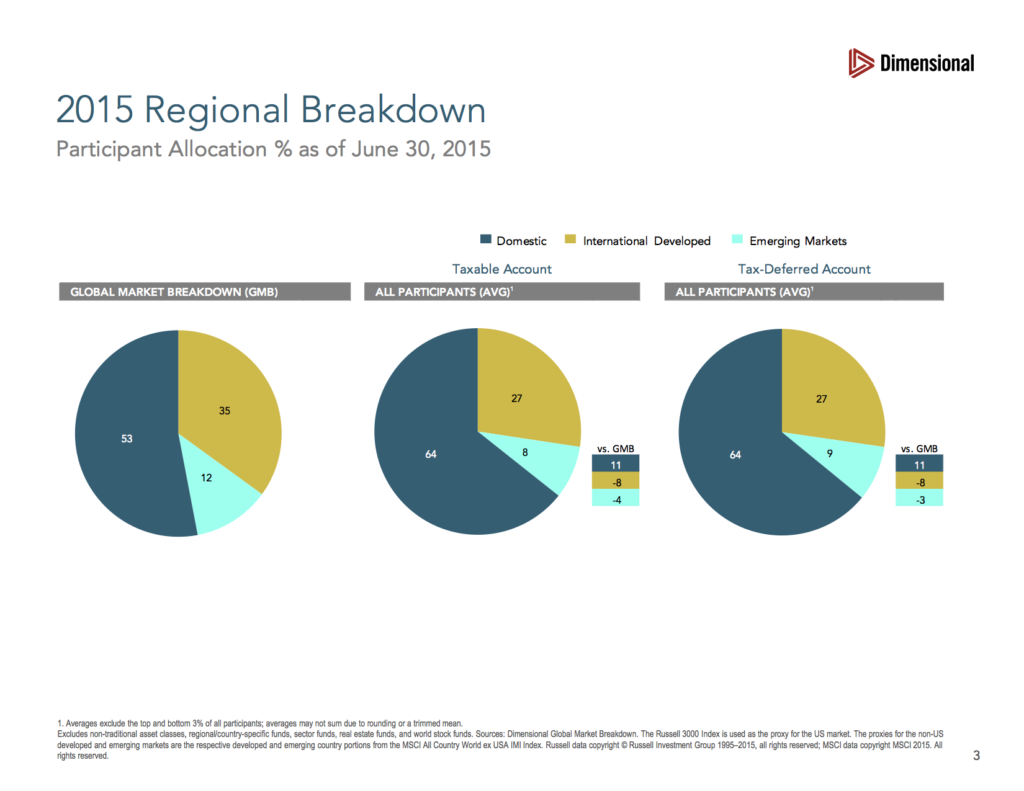

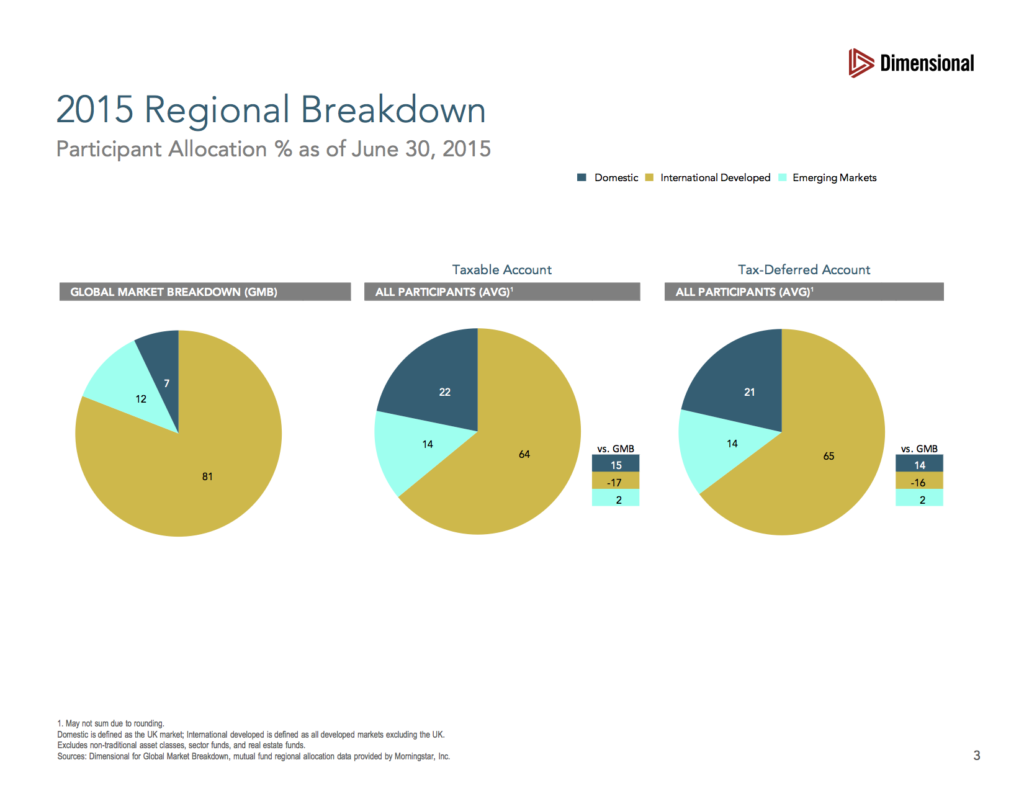

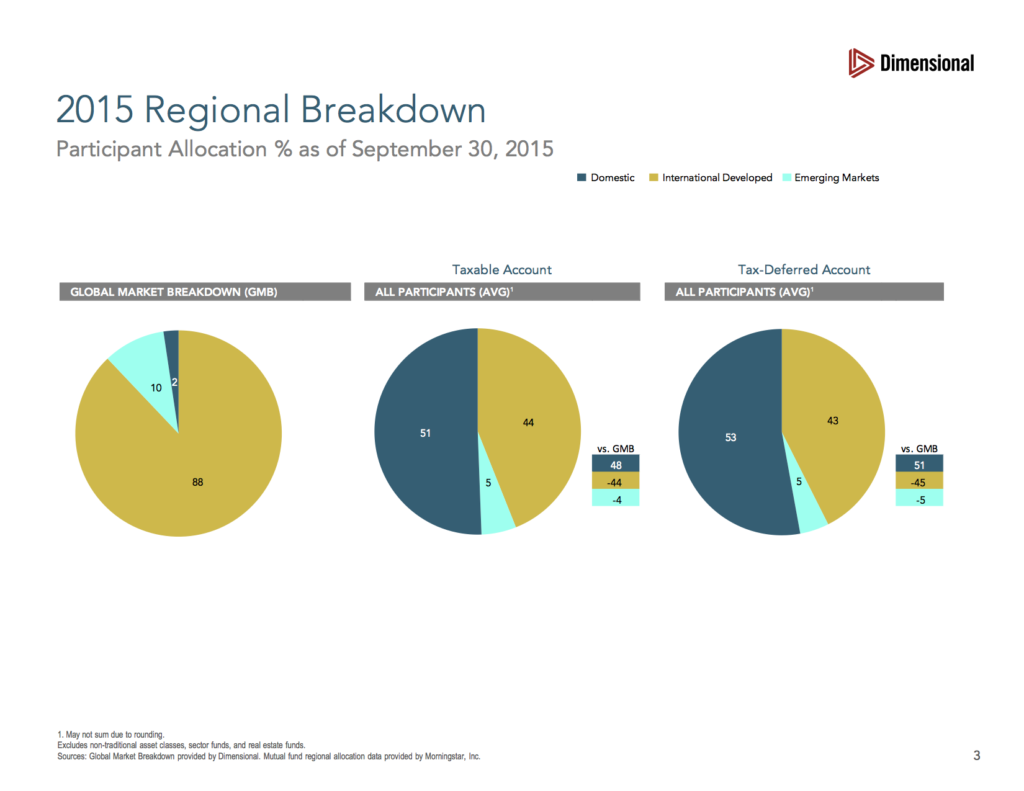

And while we’re talking about financial advisors, even financial advisors aren’t immune to home country bias. The good people over at Dimensional Funds Advisors shared a survey they conducted amongst advisors using their funds in 2015, and the results for US, UK and Australian financial advisors are represented in the charts below (in that order). Even professionals can’t shake a bias to their home countries; some of that may be attributed to client preferences and risk tolerances, but even advisors are not immune from home country bias.

As an investor, it is important to use the evidence available to construct the properly allocated portfolio for your goals. International investing needs to be a part of the portfolio, how much determines on investor risk tolerance, time horizon, and ability to stick to the investment strategy.

TLC told us no to go chasing waterfalls, and investors should not go chasing recent performance. But, investors should re-evaluate their portfolios and consult with their advisors to determine the proper allocation to reduce the home country bias in their portfolios.

Additional Reading:

Vanguard: The Global Case For Strategic Asset Allocation and an Examination of Home Bias

Vanguard: Global Equities: Balancing Home Bias and Diversification

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “Home Country Bias and Your Portfolio”

Comments are closed.