Podcast: Play in new window | Download | Embed

Subscribe: RSS

Unless you’re a CPA, you probably don’t like to think about taxes, but after listening to this episode with Bill Sweet, you just might. Bill is the CFO and resident tax expert at Ritholtz Wealth Management, one of the fastest growing RIA’s in the country, and he is the perfect guest to make taxes interesting.

Unless you’re a CPA, you probably don’t like to think about taxes, but after listening to this episode with Bill Sweet, you just might. Bill is the CFO and resident tax expert at Ritholtz Wealth Management, one of the fastest growing RIA’s in the country, and he is the perfect guest to make taxes interesting.

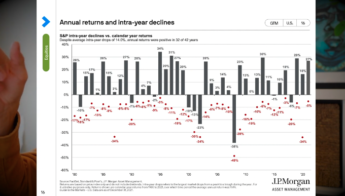

I asked Bill to join me to discuss the importance of considering the tax implications of our financial decisions. Without crossing the line of giving advice, we discuss a number of different ways to as Bill likes to say, “pay the least amount of income taxes on our assets over time”.

I cannot stress enough that the ideas Bill and I discuss should not be mistaken as advice; tax planning is dependent upon your personal situation, so consult your tax advisor to discuss ways to improve your plan.

I’ve been fortunate to know Bill for a few years now, and I always have a great time when I get a chance to talk to him. In addition to being a great advisor and tax wizard, Bill is just an overall great guy, and I’m excited for more people to get to know him!

I hope you enjoy!

iTunes: All About Your Benjamins The Podcast Ep. 022

Show Notes:

Family Inc. By Douglas McCormick

Michael Kitces: Roth vs Traditional IRA: The Four Factors That Determine Which Is Best

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimer page.

5 thoughts on “Talkin’ Taxes With Bill Sweet (022)”

Comments are closed.