iTunes Episode 18: Trick Or Treat Show Notes: BPS And Pieces: A Matter Of Principles A Wealth Of Common Sense: The Psychology Of Sitting In Cash, Part Deux The Wall Street Journal: Americans Are Divided–About Candy Corn The Wall Street Journal: The Problem When One Spouse Handles The Finances The Irrelevant Investor: All You Need To Do To Finish Rich…

Month: October 2018

Weekly Mixtape For October 27th, 2018

Week In Review Articles: The WSJ: U.S. Economy Grew at 3.5% Rate in Third Quarter The WSJ: U.S. Stocks Slump on Tech Worries Mixtape: A Wealth Of Common Sense: Martin Short’s Nine Categories For Self Evaluation “Money and career are important but they’re not everything.” The Irrelevant Investor: All You Need To Do To Finish Rich ” I’m all for finding ways to save more…

Josh Brown and Michael Batnick: “Bear Markets Suck”

“Bear markets happen because people are selling their stocks.” -Michael Batnick For good reason, there has been a lot of focus on the markets the last couple of weeks; volatility has picked up, larger sell-offs have been seen, beloved companies have been hammered, and the gains for the year have been erased in the U.S. markets in a short period…

A Deeper Dive Into Fintech With Ian Rosen (029)

The personal finance and investing experience is constantly changing and changing for the better thanks to technology; Fintech is providing education, access, and leveling the playing field and there are few people, if any, who are entrenched in the space than Ian Rose. Ian is the CEO of StockTwits, a platform for investors to trade ideas and learn from each…

Talkin’ Shop: Adam Cmejla And An Advisor’s Value

The value provided by a financial advisor is much greater than what shows up on a quarterly investment report. The trouble with trying to measure a financial advisor’s value is it’s not easy to measure and it’s also not necessarily easy for clients to identify. I asked my good friend Adam Cmejla to join me for a conversation about what…

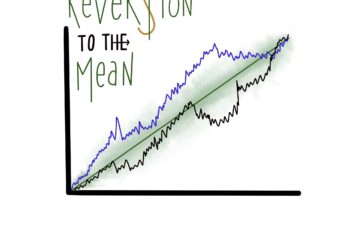

Reversion To The Mean Ep. 017: Mega Billions

iTunes Episode 17: Mega Billions Show Notes: The Belle Curve: Mega Billions Business Insider: My Portfolio Just Lost $75,000 MarketWatch: At A Time Of Market Volatility, Beware Of Rogue Advisers Who Play On Your Fears Humble Dollar: Reality Check Morgan Housel: Haste Makes Waste Jason Zweig: You’re A Bad Investor? That Can Be Good The Wall Street Journal: You Want 20% for…

Weekly Mixtape For October 20th, 2018

Week In Review Articles: The WSJ: Dow Closes Higher on Strong Earnings Reports The WSJ: U.K.’s May Urges Europe to Use Creativity to Break Brexit Impasse The WSJ: Canada’s Legalization of Marijuana Offers a Test Case for Other Countries The WSJ: Sears Closing Stores Is a Blessing for Some Landlords, a Curse for Others Mixtape: A Wealth Of Common Sense: How To Stay In…

Whiteboard Series: 4th Quarter Financial Planning Checklist

October is almost over and before you know it, December will be here and we’ll all be planning for the new year. Before you look back in late November only realize you’ve missed some important deadlines, check out this episode of the Whiteboard Series. Roman and Leo joined me today to discuss a 4th quarter financial planning checklist: Tax planning…

Atomic Habits With James Clear (028)

It all started with a tweet. I’ve been an avid reader of James Clear for the last couple of years, and when I saw he was releasing a book, Atomic Habits, I immediately pre-ordered it. Not too long after placing my order, I saw James mention he would be making the rounds in the podcast circuit so I decided to tweet…

The Behavioral Investor With Dr. Daniel Crosby (027)

Behavioral finance, the field of understanding why we make the decisions we do with money, is not a new topic for this podcast; I am fascinated by the subject and it is a tremendous honor to have Dr. Daniel Crosby on this episode. Dr. Crosby has just released a book called The Behavioral Investor, which is a must-read for anyone…