Very few advisors have embraced the cryptocurrency space as much as my good friend Tyrone Ross Jr. If you are a listener of the podcast, you will remember Tyrone as a guest earlier this year (if you’re not–you should be); he gave a great introduction to the cryptocurrency space and showed why he has become a sought-after speaker. Two days…

Month: November 2018

Talkin’ Shop: Douglas Boneparth, CFP® And Working With Millennials

I just got back from a quick trip to New York City to meet with some of the best advisors in the game; I’ve talked about the importance of networking not to grow your business, but to learn from others. I’ve made some tremendous connections over the last couple of years and have learned so much from these individuals. One…

What I’m Thankful For

Last evening I sent a short email to my clients sharing my appreciation for the relationships we have built, the trust they have in me, and for allowing me to do what I enjoy the most each day. After I hit send, I thought I’d write a post for supporters of the blog and my FinTwit friends. We all have so…

First Diversification, Now Optimization With Mike Philbrick (033)

In the last episode, we discussed the importance of diversification and now we build upon it and discuss how to optimize a diversified portfolio. Just like the last episode, we cover a number of strategies and mention some companies–these should not be mistaken for recommendations. This episode is meant to be a conversation, educational, and an exploration into investing in different…

Progress–But Still Room For Improvement

In November 2016, I wrote a blog post sharing my bullishness on the financial services industry. I’m even more bullish now than I was back then, but I was recently reminded just how far the financial advisor community still has to go. Last week I was fortunate enough to have the opportunity to hear Ron Carson speak in Indianapolis and…

Getting Comfortable With Being Uncomfortable With Mike Philbrick (032)

There is overwhelming evidence suggesting diversification provides a tremendous “free” benefit for investors. Yet despite the evidence, many investors fail to properly diversify. Whether it be overweighting to their home country, chasing returns, or not even having an investment strategy, too many investors underperform due to succumbing to behavioral biases or ignorance. In this first of a two-episode series, I’m joined…

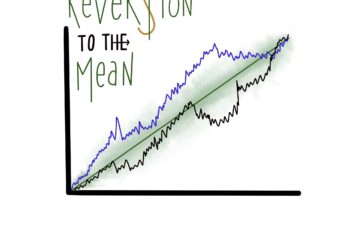

Reversion To The Mean Ep. 021: Avoid The Struggle

Forbes: The Big Millennial Life Insurance Gap The Wall Street Journal: How Millennials Can Maximize Savings For Retirement A Wealth Of Common Sense: What If You Retire At A Stock Market Peak? Humble Dollar: Fanning The Flames Nat Eliason: No More “Struggle Porn” Khe Hy: The Gnarly Truth About The Content Business The Carnivore Diet Scott Galloway Daily Insights Disclaimer: Nothing on this blog should…

Talkin’ Shop: Mike Philbrick And The Importance Of Fitness And Nutrition

If you’re a reader/listener/viewer of All About Your Benjamins you probably have a good grasp of your financial planning or are at least in the process of getting it in good shape–while you continue to do this, don’t forget to keep yourself in good shape. There are many reasons to focus on eating healthy and being in good physical shape. Lower…

Weekly Mixtape For November 17th, 2018

Week In Review Articles: The WSJ: Global Economy Shows Strain As U.S. Steams Ahead The WSJ: Saudi Arabia, Others Inch Closer To Oil Output-Cut Pact The WSJ: Inflation Jumps, But Is Likely To Slow The WSJ: Amazon Announces HQ2 Winners Mixtape A Wealth Of Common Sense: What If Your Retire At A Stock Market Peak? “Retiring just before a stock market peak could be ruinous to your…

Is Your Financial Advisor Doing A Good Job?

Originally posted in the RLS Wealth Management Notes on November 15th, 2018 Depends. It depends on how you are looking to measure your financial advisor’s success. It is very common for clients to evaluate their advisor based on the performance of their investment portfolio, which makes sense since it is the most tangible and measurable aspect of the financial planning…