When I first started to write this blog, I remember hearing Barry Ritholtz say he writes for an audience of one…himself. I have to admit, that is great advice I never followed—I’ve viewed All About Your Benjamins as a way to communicate/educate and hopefully one day grow my business. Because of this, I have always written with an audience beyond…

Month: December 2018

Reversion To The Mean Ep. 025: Live From Fishers

The Wall Street Journal: When Couples Retire—And Then Start A Business Bloomberg: Forget Drones. Amazon’s Jeff Bezos Needs Lots Of Delivery Humans AQR: Once More, Without Feeling A Wealth Of Common Sense: Big Up Days In The Stock Market Morgan Housel: Investing Ideas That Changed My Life The Seattle Times: Pensions Provide A Welcome Cushion As Seattle Couple Eyes Retirement Options CNBC: The Budget Breakdown Of A…

Weekly Mixtape For December 29th, 2018

With the shortened holiday week I decided to skip the video and hang out in bed with Silas for a bit. Here are a few articles recapping some of the headlines, but there weren’t many other than some volatile days in the market, which really shouldn’t be newsworthy to long-term investors. I’ll be back next Saturday with a new episode of…

Talkin’ Shop: Kevin From Fervent Finance and DIY’ing

You might recognize Kevin from the podcast he and I host, Reversion To The Mean, but what you might not know is Kevin is not a financial advisor, or even in the business. I met him a couple of years ago at the XY Planning Network Annual Conference, he was my first guest on All About Your Benjamins The Podcast,…

And The Pendulum Swings

December 24th, 2018: Dow ends down 651.27 “Worse Christmas Eve In History” December 26th, 2018: Dow ends up 1,086.25 “Biggest Single-Day Point Gain In History” Dow up 1,000 points?!? Trade war over? Everyone cool with the Fed now? Political landscape no longer a dumpster fire? Oh, nothing substantial has changed since Christmas Eve? Hmmm… — Justin Castelli (@jus10castelli) December 26, 2018…

Weekly Mixtape For December 22nd, 2018

Week In Review Articles: The WSJ: Stock Rout Puts Nasdaq in Bear Market The WSJ: Fed Raises Rates, but Signals Slightly Milder Path of Future Increases The WSJ: James Mattis to Depart as Defense Chief Over Troop Withdrawals from Syria, Afghanistan The WSJ: Want a Better Credit Score? Soon, Your Cellphone Bill Could Help WISH-TV 8: These Drivers Expected Tickets But Got A WISH Patrol Surprise (I’m…

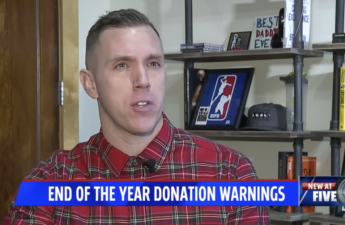

RLS Wealth Management on Fox 59 News: Charitable Donations And The New Tax Law

With the combination of an increased standard deduction and capped state and local tax deductions, along with other new laws within the tax code, fewer taxpayers seeing a deduction for their charitable contributions. But, as I explain to Fox 59 and CBS 4’s Jill Glavan that doesn’t mean taxpayers will be worse off, or that charitable giving will see a decline.…

Talkin’ Shop: Ryan Kirlin And ETFs

I love when friends from out of town drop in, and I love it, even more, when we can squeeze in a workout. Ryan Kirlin from Alpha Architect happened to be in Indy for the day and was kind enough to stop by RLS Wealth Management headquarters to visit for a bit, talk about the current state of ETFs, and…

Why Financial Advisors Love Data

Have you ever wondered why financial advisors quote statistics, charts, and graphs? The data contained in statistics, charts, and graphs used by advisors often backs up the plans created for our clients; it provides the evidence needed to help clients (or readers) stay in the game when emotions begin to cloud their decisions. Be careful though, the data can also…

Talkin’ Shop: Peter Dunn and Year-End To-Do’s

You can’t be interested in personal finance in Indianapolis, or in the U.S. for that matter, and not know Peter Dunn; you just may know him by a different name–Pete The Planner. A former financial advisor turned financial educator, Pete has become a friend over the last year and has been someone I’ve looked up to for years for the…