There has been a lot of talk lately (I almost did this Whiteboard a couple of weeks ago) about a possible earnings recession. When people hear “recession” they often think about 2008 and economic recessions. Well, earnings recessions are not the same and I explain how in this episode of The Whiteboard Series. Be sure to check below the video…

Category: Whiteboard Series

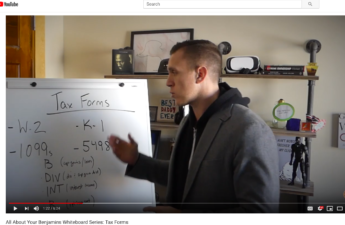

Whiteboard Series: Tax Forms

February is knocking on our door, which means it’s probably time to start thinking about and planning for tax time. If you have investments, there are a number of tax documents you will receive from your custodian, and sometimes they can be confusing, or even scary. In this episode of the Whiteboard Series, I cover the most common tax forms individuals…

Whiteboard Series: 4th Quarter Financial Planning Checklist

October is almost over and before you know it, December will be here and we’ll all be planning for the new year. Before you look back in late November only realize you’ve missed some important deadlines, check out this episode of the Whiteboard Series. Roman and Leo joined me today to discuss a 4th quarter financial planning checklist: Tax planning…

Whiteboard Series: An Investment Strategy Does Not A Financial Plan Make

I recently exchanged emails with a potential client and before we had a chance to talk about his personal situation he let me know he had talked to a couple of other “advisors” and was just going to focus on maxing out his 401(k) for the time being. Keep in mind, I don’t know if maxing out his 401(k) was…

Whiteboard Series: Estate Planning (Again)

We’ve covered Estate Planning on the Whiteboard Series before, but with the passing of Aretha Franklin and learning that she did not have a will or trust in place, I thought it would be a good time to revisit the importance of getting the appropriate documents in place. While we may not all be as wealthy as Aretha (or Prince),…

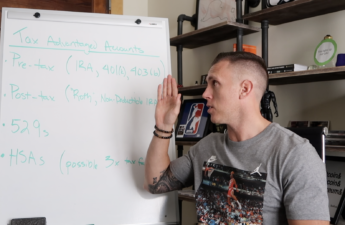

Whiteboard Series: Tax-Advantaged Accounts

This week I recorded and released an outstanding conversation with Bill Sweet of Ritholtz Wealth Management on, of all things, taxes. Yes, I know taxes are not a favorite subject for most people, but it is an important part of a financial plan. As you’ll learn from Bill, proper usage of tax-advantaged accounts can help provide a boost to your…

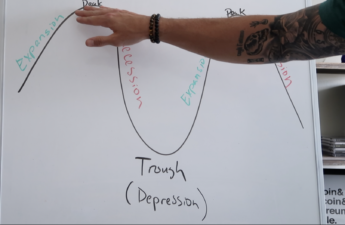

Whiteboard Series: The Business Cycle

In the last Whiteboard Series Video we covered the inverted yield curve and why everyone is talking about if it happens–the last nine inverted curves have led to a recession. In this episode, we take a look at the business cycle as a precursor to talking about recessions in the next video. I think it is important to understand that…

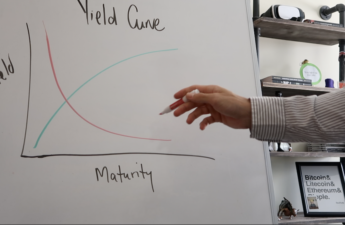

Whiteboard Series: The Inverted Yield Curve

If you haven’t read about or heard of the inverted yield curve, you probably will soon; it’s been a hot topic for financial media as of late and it will probably remain so for a while. In this episode of The Whiteboard Series, I try to keep this complex phenomenon at a high level and focus just on the basics. So,…

Whiteboard Series: Wealthy vs. Rich

The whole squad is back again for the first Whiteboard Series Video in the new office. In this episode, we are taking a different approach–instead of just defining a financial planning term, we’re discussing a topic that has been of great interest to me as of late; I’ve been asking every podcast guest about this and my most recent podcast…

Whiteboard Series: Disability Insurance

My whole squad, well everyone but Mom, joined me over the weekend a new Whiteboard Series Video. Insurance is no one’s favorite subject, except for insurance salespeople, and in this week’s Whiteboard Series Video we quickly cover the importance of disability insurance. This is not the first time disability insurance has been covered on the blog, and it probably won’t…