Week In Review Articles

CNBC.com: U.S. Jobless Claims Show Surprise Gain, Well Above Expectations

The WSJ: Stocks Rebound After Dramatic Selloff

The WSJ: Dow Tops 35000 as Stocks Rise to Records

The WSJ: Tesla CEO Elon Musk Says He Personally Owns Bitcoin—And So Does SpaceX

The WSJ: FICO Score’s Hold on the Credit Market Is Slipping

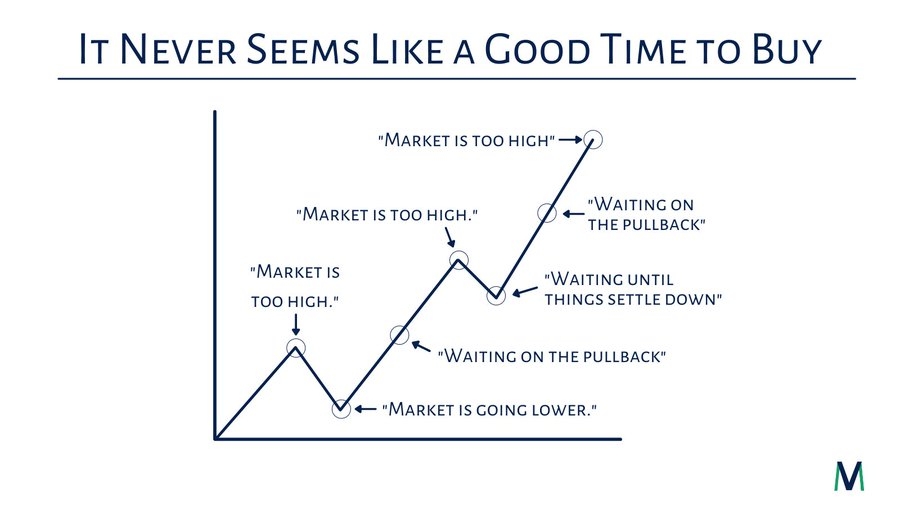

New Feature: Weekly Image From MoneyVisuals. Each week, in addition to a favorite tweet, I will share an image from MoneyVisuals that I really like.

I’ll buy the next pullback.

— Michael Batnick (@michaelbatnick) July 23, 2021

Weekly Mixtape

Morgan Housel: The Highest Forms Of Wealth “There’s a difference between working hard because you want to and working hard because someone else told you you had to, and how to do it, and when to do it.”

A Wealth Of Common Sense: Making It Look Easy Is Hard Work (an old one, but great one!!) “The people who make it look easy need talent to succeed. But more often than not, the only reason it looks so effortless is because they put in the time and effort before you ever see the end result.”

The Irrelevant Investor: Buy Stocks “People look for ways to hedge against inflation when one of the best hedges is staring us right in the face.* Not only can businesses raise their prices, but they can raise them more than their costs.”

A Wealth Of Common Sense: How To Predict A Market Crash “And since market crashes are fairly infrequent, if you keep predicting one you’re going to be wrong way more often than right.”

Aleph Blog: Humility “I’m not saying don’t take moderate risks to improve your position in life. I am saying that trying to hit home runs begets a lot of strikeouts. If you are not capable of bearing the losses of strikeouts, don’t try to hit home runs. Instead, try to hit singles more reliably.”

A Teachable Moment: Understanding The Harsh Reality Of College Scholarships “Most athletic scholarships must be renewed yearly. They’re at the coach’s discretion. An injury or falling out with the staff could lead to revocation. In addition, the high-pressure atmosphere isn’t conducive to colleges’ main purpose- getting a good education.”

Jordan Nietzel: The Case For Investing Your Emergency Fund “Investing your emergency fund in a diversified allocation of stocks and bonds is not without risk, but leaving it in an account where inflation will slowly dwindle the purchasing power away is also not risk-free.”

Matt Fizell: Bucks In 6. Simplify Your Money In 6 Steps “Many times with our finances, it can feel similar to the Bucks road to the championship. We are really close to figuring it out and putting all the pieces together, but then something (like a pandemic and the NBA “Bubble” we saw in 2020) comes out of nowhere and shifts us away from our momentum.”

Phil Pearlman: Dr. Phil’s August Walkabout “I like to meditate when I walk and just let my mind wander too. Plus, it’s a gateway drug to other healthy behaviors like other types of movement, better sleep, and better nutrition.”

Thomas Kopelman: Never Stop Compounding Interest “He is saying that compound interest sees its biggest value in the later years of compounding so your goal should be to never allow short-term events to stop compounding from working in your favor. “

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.