Whether it be acting on a hot stock tip, or the plan to profit off your favorite company’s success, the allure of stock picking is hard to deny. Despite overwhelming evidence suggesting that it’s an uphill battle for individual investors, we (myself included) cannot help ourselves. Sure, there will be the occasional short term success, but in the stock market, luck only lasts a short time. Any long-term, nonprofessional investor thinking they can buck the trend is in denial and suffering from a severe case of overconfidence.

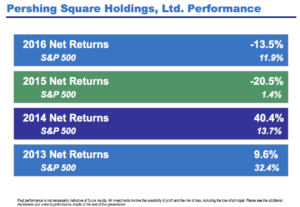

This week saw one of the hedge fund community’s greats remind us all how easy it can be to let an investment get away from us. In case you do not actively follow the financial media, on Tuesday Bill Ackman, the founder and CEO of Pershing Square Capital Management, finally exited his position in Valeant Pharmaceuticals (ticker VRX) for a nearly 95% loss…that’s right, 95%. As you can see in the chart, it’s been a rough few years for Pershing Square (and most hedge funds for that matter). If one of the most recognizable hedge fund managers can have difficulty successfully picking stocks, you may want to rethink your attempt at becoming your own stock portfolio manager.

Let’s pause here for a minute…this is in no way a hit piece on Bill Ackman. I would be a fool to criticize the founder of a company managing nearly $11 billion (as of 12/31/2016) in assets, nor would I want to invite karma to come back at me. You don’t get to be as successful, respected and well-known as Bill Ackman without making your investors money. He’s had great success in the past, and I have no doubts that he’ll be back in the black before we know it. Instead, the purpose of this post is to illustrate to investors why it may be best to leave the stock picking to others and rely on a boring diversified, low-cost portfolio for their investing.

Over the last year and a half, there has been no shortage of coverage on Valeant Pharmaceuticals, the company’s troubles and the impact on the stock price. And rarely has the company been discussed without mention of Bill Ackman and his stake in the company. Rather than recap the whole story, I’ve included a few links to other articles that give all of the details. Please check them out to learn more about how a company loved by the smart money fell so hard.

By closing out his position, Ackman realized a loss of $3-$4 billion dollars (I’ve seen multiple estimates in this range)–remember, it was a 95% decline. When Pershing Square first entered Valeant, the stock price was trading in the $200 range. After a slight decline, the stock climbed to it’s all-time high of $262 before falling to $11. Think about this, a professional money manager stuck with a stock from $262 down to $11. Surely there were plenty of warning signs and reasons to get out of the stock before Tuesday; you read the articles, right?

Hindsight is and always will be 20-20, which is why stock picking is so difficult. It’s always easy to look back and pinpoint when you should have gotten out, or bought more. But in the moment, it’s not so easy. Obviously, Ackman had a strong conviction in his position in Valeant. And he wasn’t alone. The Sequoia Fund, a stalwart in the industry and a Warren Buffet favorite, also held a highly concentrated position in Valeant. You can see below the impact of Valeant on Sequoia; while the S&P 500 has been moving upward, Sequoia significantly underperformed.

While Bill Ackman and The Sequoia Fund can survive a bad investment like Valeant Pharmaceuticals–both still manage billions of dollars, allowing them to live to fight another day–the rest of us would not be so fortunate. Most investors seek the stock market to help grow their savings for long term goals like college funding, or retirement, and a 95% loss in a single position would most likely derail those plans. While we all hope to find the next Celgene (read my friend Michael Batnick’s post about CELG), those opportunities are few and far between. If you have the fortune of finding one, you have to manage your emotions as you stick with it for the long run, and you’ll need to know when to get out, which may not be an easy thing to do.

Instead of trying to win the stock market lottery, a financial plan complimented with a diversified portfolio is the tried-and-true method to long term wealth accumulation. It may not be as sexy, and it may not give you a lot to brag about over drinks with friends, but why are you investing? Is it to have a good story, or one-up your neighbor? Or is to accumulate the savings needed to reach your goals?

Think back to the snapshot of the performance of Pershing Square over the last 4 years, and then look at the chart below of Dimensional Fund Advisors Global 60/40 Allocation. With the exception of 2014 when Pershing had a great year, the DFA fund looks more appealing, and over the time period would have been a smoother ride with better results.

Source: YCharts

Let’s come back to Mr. Ackman one more time. As I mentioned, he has a tremendous track record as a hedge fund manager, and it hasn’t been until recent that his performance has come under pressure. I’ve already highlighted Valeant (JC Penney was another doozie), but he also currently has Chipotle and a short position (betting against the company) in Herbalife working against him. So we’ll see how those investments play out–right now, it’s not looking too good. If a professional with access to more information, spends all of his time researching and analyzing his investments, and has more experience than the average investor is not immune from the perils of stock picking, why do you think you are?

K.I.S.S.

Additional Reading:

Yahoo Finance: A Brief Timeline of the Bill Ackman-Valeant Relationship

Bloomberg: Sequoia Significantly Cuts Valeant Stake, Limits Position Sizes

The New York Times: William Ackman Sells Pershing Fund’s Stake in Valeant

Pershing Square Annual Update Presentation

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “The Allure of Stock Picking”

Comments are closed.