A couple of weeks ago in my newsletter for financial advisors I wrote about our current situation being “The Great Reset”—I know I’m not the first person to use this phrase, although I don’t remember seeing it anywhere before it hit me. In the newsletter I explained how this slow down in life, despite the inconvenience and frustration it might…

Lessons From Michael Jordan And The Last Dance–Presented By YCharts

For the last five Sundays at 9:00 PM EST, my family was glued to the TV. No iPad. No computers. No distractions. Just us and the 1990’s Bulls. It was a blast to relive the “old days” (I can’t believe I can actually say that) and for the boys to be able to see REAL basketball. It’s safe to say…

Digital and Crypto Assets With Tyrone Ross (IG Live Episode)

Apple Podcasts: Click Here To Listen On Google Podcasts I wouldn’t call this a Crypto and Digital Assets 101 class, but as I’ve begun receiving more questions about cryptocurrency I thought it would be great to bring Tyrone Ross baby (he’s a former AAYB podcast guest on the subject) to discuss the topic—covering some of the basics, along with some…

Weekly Mixtape For May 17th, 2020

No Week In Review Video This Week–We Were Enjoying The Beautiful Day Yesterday And Have A Photoshoot For Mom’s Store, Roman & Leo, Today. I’ll Be Back Next Week With Your Week In Review Video!! Week In Review Articles The WSJ: Stocks Fall as Fed’s Powell Says Outlook ‘Highly Uncertain’ The WSJ: Nearly Three Million Sought Jobless Benefits Last Week The WSJ: Consumer…

I Need Your Help Bringing Financial Advice To CNBC

Last Friday, my friend and mentor Josh Brown brought financial advice to CNBC and I want to see more of it. But I need your help. I don’t have any inside information, but I have to believe this episode (along with an earlier one a few weeks ago) was a test to see if viewers want to see a show…

Weekly Mixtape For May 10th, 2020

Week In Review Articles The WSJ: April Unemployment Rate Rose to a Record 14.7% The WSJ: Stocks Close Higher Despite Grim Jobs Report The WSJ: Why Is the Stock Market Rallying When the Economy Is So Bad? CNBC: US Treasury Seeks To Borrow A Record $3 Trillion This Quarter The WSJ: Some Americans Are Being Turned Away Trying to Buy Life Insurance 20.5 million…

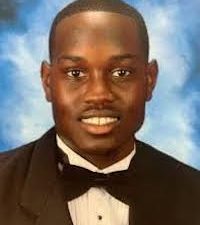

#RunWithMaud

Yesterday, Wednesday, May 6th 2020, the video of the murder of Ahmaud Arbery auto-played on my Twitter feed, and I have not been able to get it off my mind. If you have not seen it, I don’t encourage you to seek it out–all you need to know is you can see Ahmaud fight for his life, try to run…

Where Does Money Come From & Do Most People Save Or Spend Their Money?

It’s been two weeks since Roman and Leo’s last haircut, which means this weekend another round of Haircuts and Convos went down. Instead of asking them the questions, I let them do the asking. Naturally, I managed to work in a question of my own…if you had enough money to never have to worry, what would you do? Leo kicked…

Weekly Mixtape For May 3rd, 2020

Week In Review Articles The WSJ: U.S. Economy Shrank at 4.8% Pace in First Quarter The WSJ: Coronavirus Prompts Record Drop in Consumer Spending The WSJ: Over 3.8 Million Americans Filed for Jobless Benefits Last Week as States Struggle With Coronavirus Claims Surge The WSJ: Fed’s Powell Says More Spending Will Be Needed From Congress The WSJ: America Looks to Reopen From Coronavirus but Disagrees…

Guest Appearance On Chit Chat Money Podcast

Last week I got the chance to join the fellas over at the Chit Chat Money Podcast. I was impressed by what these two young men have been able to build. Brett Schafer and Ryan Henderson are way ahead of their peers–not just in investing, but in the fact they have launched a blog and podcast while finishing up college.…