Hopefully, you read the title as if you were singing ILoveMakonnen’s “Tuesday”!

Today was supposed to get off to a great start…it’s National Donut Day. But, the first article I read on Twitter put a bit of a damper on the national holiday. It is a national holiday, right? According to an article by a local news station, Anthem is predicting a 20-40% premium increase for their Indiana Marketplace Insurance Policies¹. It’s generally expected for insurance premiums to increase from year to year, but 20-40% isn’t just an increase, it’s a jump. Unfortunately, not much can be done about it since going without health insurance is not an option; it isn’t financially responsible, not to mention it’s illegal. The increase in premiums will impact households across the country, but it will impact one demographic more than most…the small business owner (Note: You could also lump some early retirees into this category as well).

The small business owner is near and dear to my heart. Personally, my wife and I each own our own businesses, and I have an increasing number of small business owners and entrepreneurs as clients. I naturally thought of my own budget and where I can trim in 2017, and then I started to think about the impact of higher premiums on the financial plans on my clients. If premiums do increase at the predicted rates, we will need to adjust budgets, savings plans, and overall financial plans to account for higher insurance premiums without subsidy relief.

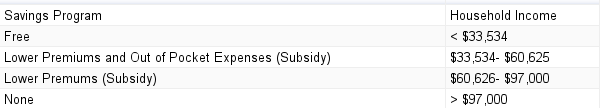

With the Affordable Healthcare Act, a subsidy based on income is designed to lessen the cost of insurance for Marketplace participants. However, as you can see below, not everyone qualifies for a subsidy, which results in a substantial percentage of household income going towards insurance premiums.

Source: Healthcare.gov

With the average household income at $53,657², it’s hard to sympathize with a household income greater than $97,000. When I was growing up, $100,000 seemed to be the income goal; if you were able to reach six figures, you’d be set. But, if the household relies on a small business owner for that income, it’s likely a high percentage is going towards insurance premiums. $100,000 today isn’t what it used to be, and when it comes to the Affordable Healthcare Act, $100,000 is one of the worst places to fall.

Let’s look at some numbers: My family currently pays $1,193.14 a month for our Silver Marketplace policy. With the projected increases, our premium will jump to somewhere between $1,400 and $1,600 a month. In the worst case scenario, 19% of a household making $100,000 a year would be gobbled up by insurance premiums. And that’s just premiums; have another baby, or God forbid someone gets sick, a minimum of 25% of the budget will be going towards healthcare expenses. That $100,000 isn’t as much as it once seemed anymore.

Needless to say, the high increase in insurance premiums for small business owners has me concerned.

It has me concerned about the impact on the US economy. I realize that small business owners making around $100,000 is a relatively small percentage of the overall population, but with an economy that is slowly growing, it can use as much help from the consumer as possible. With these increases, it should be expected that there will be less coming from these households in the upcoming year. Hopefully, the small business owners in this situation today will see their companies grow in the coming years to put them in a position where insurance premiums make up a smaller percentage of their income, and they will be able to get back to contributing to the economy. We shall see.

It has me concerned small business owners will be forced to close their businesses because of the cost of insurance. An entrepreneurs dream shouldn’t be squashed by the cost of insurance.

It has me concerned about the retirement planning for small business owners. With more going towards insurance, less may be going to retirement. The majority of Americans are already greatly underprepared for retirement, and this may worsen the problem.

It has me concerned about the impact on future small business owners. I’m afraid the high cost of insurance will deter potential small business owners from starting their own business, instead sticking with a job because of benefits. Small businesses are a driving factor in the economy’s growth, and without them, the economy is not as strong.

So, what is a small business owner to do? What’s the answer? Unfortunately, I don’t have one, and that bothers me because I’ve always been told not to bring up a problem without having an answer for it. So why write this?

First, and foremost, I wrote this to educate any readers who own small businesses about the potential increase in insurance premiums. Preparation should begin now, and not in November when the official premiums are released. I also wanted to give insight on one of a small business owner’s major hurdles. Given that most families get their health insurance through an employer plan, they are not familiar with the Marketplace plans. And, although employer plan rates are not immune to annual increases, I have not come across any in the 20-40% range.

Finally, I wanted to encourage readers to consider shopping small whenever they have the chance. The dollars spent with a local business have a greater impact on the economy, the community, and the business owner than those spent with corporate businesses.

Sources:

- https://wishtv.com/2016/06/03/indiana-health-insurance-costs-expected-to-climb-in-2017/

- US Census Bureau 2014 report, September 2015

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “Health Insurance Premiums Going Up, in 20-17”

Comments are closed.