If you look up inertia in the dictionary you will find its definition to be (emphasis is mine) “the resistance of any physical object to change its velocity. This includes changes to the object’s speed or direction of motion.“

Inertia is the glue preventing too many individuals from chasing their dreams, from finding and living their purpose, and from living a fulfilled life. It’s easy to want to make a change. It’s hard to make change happen. Too often, whether it be with weight loss goals, savings goals, or career goals, individuals set an ambitious, but attainable, goal only to give up shortly after starting due to some type of set back. They get off to a great start but life brings an unexpected challenge and they never manage to get back on track—the goal they are chasing seems too far away—and fall back into the rut they so desperately want to escape. Inertia grabs ahold again.

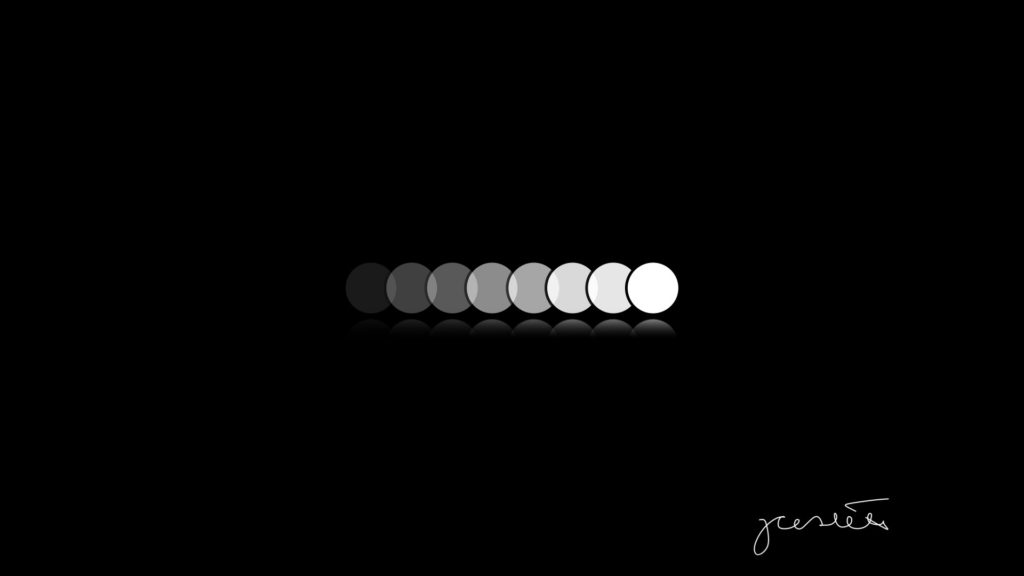

If inertia keeps us stuck on the same path, then we must look to create momentum to break through the inertia and reach our desired path. Momentum refers to an object’s tendency to stay in motion—meaning once an object gains momentum it tends to stay in motion; inertia prevents an object from gaining momentum. They aren’t quite opposites in definition, but I consider them opposing forces.

When chasing your goals, build momentum, and build it as fast as possible—avoid inertia’s pull to keep you in place.

Stacking Wins

Building momentum can be accomplished by setting smaller, micro, goals on your way to your ultimate goal.

You don’t set out to run a marathon by heading out of the house and running 26 miles on Day One of training. You’d fail. You’d get discouraged and ultimately quit, never reaching your goal. Instead, you plan, train, and build up to 26.2 miles. You start small—build your confidence, your endurance, and achieve micro-goals along the way. 1 mile, 5 miles, 10 miles…all the way up to your marathon. Each milestone is a mini-celebration and keeps you progressing toward your goal. I can’t believe I chose a running example as my first example given my disdain for running.

Accumulating $100,000 (or $500,000, or $1million, or $50,000…pick your number), like running a marathon, doesn’t happen overnight either. Planning on going from $0 to $100,000 is setting yourself up for disappointment and ultimately, failure.

Planning on going from $0 to $1,000, then $1,000 to $5,000 and so on is a much better approach to reaching your goal, whatever that number might be. Giving yourself micro-goals changes your focus from the daunting $100,000 goal that seems so far away to more manageable amounts that will continue to move you closer. You’ll go from $0 to $1,000 to $5,000 to $10,000 and before long that $100,000 goal won’t be too far away and the momentum you have built up hitting your micro-goals will carry you to the final amount—don’t forget, momentum keeps an object, your savings, in motion.

If this concept of stacking micro-goals to help you reach your ultimate goal is of interest, I highly recommend you check out James Clear’s book Atomic Habits. You can also check out my conversation with him when he joined me on All About Your Benjamins The Podcast. Building good habits will not only help you quickly build but also maintain your momentum.

Whether you want to change your financial situation, improve your health and wellness, or chase your passions don’t neglect to build momentum to help you reach your goal. Not only will the momentum you build keep you excited on the pursuit of your goals, but it will also carry you through the obstacles you will face along the way—there will be obstacles. You will find inertia trying to slow you down when these obstacles present themselves. Just keep focusing on stacking those micro-goals building your momentum.

It’s like 50 Cent said, keep stacking those micro-goals and watch your goals pile up…well, maybe he didn’t exactly say that, but it was something like it 😀.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

2 thoughts on “Momentum”

Comments are closed.