I’m finally getting around to reading How I Invest My Money by Josh Brown and Brian Portnoy—it’s a book about how financial professionals manage their money and financial plans. It’s filled with stories from some of my very close friends and I love to see my friends highlighted in such an amazing and important book.

As I read a couple of chapters last night, I began to think about my money story…

“Pay Yourself First”

Those are the first words I remember when it comes to money. I don’t remember how old I was, but I distinctly remember my dad explaining why it was so important to take care of yourself first—pay yourself first. I don’t remember the details that followed, but I do remember that phrase.

And it has always stuck with me.

Growing up, I had every privilege you would expect from a middle-class white family in America. We didn’t live an extravagant life, but we also did not want for much…

I don’t remember a lot of conversations about money as a family—we were taught to save, delayed gratification (which I need to get better about with my boys), and I don’t ever recall seeing my parents argue about money—not once. Although we didn’t have in-depth conversations about money as a family, I do remember talks with my dad as we’d drive to the YMCA to work out or play basketball and periodically he’d give me updates about raises or how much money he was making at the time. I remember his march toward his goal of six figures, which didn’t happen until I was at least in middle school.

As a family, we were very fortunate—although now as I look back as an adult, I wonder if there were times things were tighter than we realized. For the longest time, my dad would take the bus to downtown Indianapolis for work—I remember running outside around 5:00 each day to watch him from a distance walk home from the bus stop—that walk had to be about a mile. While many of my friends had two cars, we had one for most of my childhood—first world problems, I know. But because I never saw my parents argue or stress about money, I never thought twice about our financial situation.

I think the reason they never fought about money was that they were on the same page. My parents decided early on that my mom would stay home to be with my sister and me—they made an investment in our family and sacrificed a second income. My mom could have worked, we could have had a bigger home, a second car, and took more vacations, but the trade-off of less family time was not in line with their values.

In high school and college, I saw my dad take some calculated risks in his career that did not pan out. Multiple times he put his trust into other people and was left on the outside looking in. At the time, I had no idea the financial impact on our family the failed business ventures had—our family continued to live as we had. So, I just assumed everything was all good.

I went to a private college to play basketball, went on spring breaks, bought things whenever I wanted them, and just lived a very comfortable life—meanwhile, our family’s income had dropped significantly. The truth finally came out in the last year as I was working on Social Security planning for my parents and I saw my dad’s income history on his Social Security statement. When I say things were lean for a couple of years, things were LEAN.

I wish I would have known what was going on because I would have changed how I was living my life. I would have been more mindful of spending, I would have gotten a job, and I would have found ways to contribute to help while our financial life worked its way back to normal. But, I know that would have caused my dad more grief than the situation he was in.

My dad is a provider—he is the most selfless person I have ever met. He valued his family not worrying about money more than his ability to retire early or have a huge investment portfolio in the future. It’s not right or wrong—it’s just where he placed his values for money.

Earlier this year I was talking with Tyrone Ross (a contributor to How I Invest My Money) and shared how I finally connected the dots between my childhood and how I view my family’s finances.

The connection between being told “pay yourself first” to the saving my wife and I have done was obvious, as was the intentional structuring of our financial plan around our family to create memories and experiences being an obvious connection to how I grew up. But, what was less obvious was my obsession with ownership. Growing up nothing about me resembled an entrepreneur, but now I couldn’t imagine being any other way.

All because of my dad’s experiences of relying on other people.

At one point in my career, while I was working for a large corporation, I realized at any moment they could cut my pay, take away my territory, or fire me and I’d be left with nothing—I had no reason to believe any of those events would happen, but I told myself I never wanted to be beholden to anyone who could control my financial security. I wanted to be in total control. This desire to be in control is most likely embedded in my subconscious after seeing my dad get let go during a restructuring of his company after being there just shy of 25 years—and 25 years was what he needed to be vested in a nice pension. In one moment, a decision by someone in upper management, drastically changed my father’s retirement—not because he was a poor performer but because someone decided his department was dispensable. Not only did this change my dad’s life, but it changed mine—it just took me twenty-some years to realize it.

When I entered the workforce I immediately enrolled in my company’s 401(k) and have done so at every company I worked for–I made sure to pay myself first. My wife did the same and we were fortunate to do well early in our careers financially and we took full advantage of our ability to save, which laid the foundation of our financial plan and portfolio.

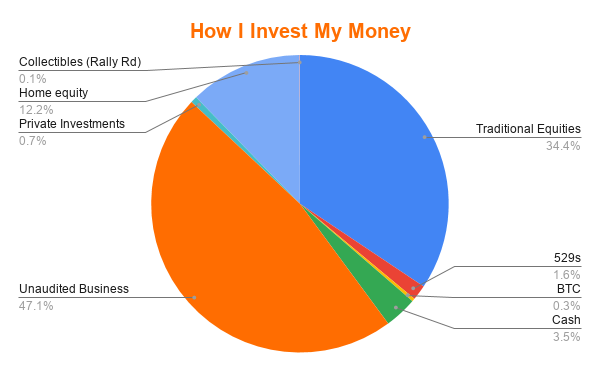

As a family, we have IRAs from old 401(k)s, Roth IRAs from years we were able to continue and Roth 401(k) rollovers, a SEP IRA, a newly formed Simple IRA, 529 plans, and taxable investment accounts. We contribute regularly to my SEP IRA, which will stop with the RLS Simple IRA starting in January 2021, the boys’ 529 plans up to the max limit for Indiana’s State tax credit, weekly contributions to our taxable account, and weekly contributions into bitcoin.

Our investments in these accounts are primarily in low-cost ETFs and mutual funds—the same funds RLS Wealth clients are invested in. I believe in investing alongside my clients—if it’s good for them, it’s good for me. I do have one account where I buy individual stocks because I enjoy doing so—it’s my fun account, but it is a small percentage of our investable assets. I’m currently researching and working on an effective and efficient way to incorporate some stock investing in client portfolios, where it makes sense.

I’ve also set up a couple of accounts with some cool Fintech companies. I have an account with Public.com, which will be the account I educate the boys on investing. We will be putting some funds into the account and they will pick the stocks to invest in—we’ll discuss why, the risks, and more. I plan on recording this and putting it on the RLS Wealth YouTube channel for educational purposes.

I also have an account with a company called Rally Rd., which allows me to invest in collectibles—this is totally for fun right now, but I could see this being a legit part of portfolios in the future. I currently own shares in game-worn rookie year Michael Jordan shoes, a complete Pokémon set, prototype Nike running shoes from the ’70s, and an unopened box of 1986 Fleer basketball cards.

That’s it for traditional investments—going forward we’ll continue saving into my Simple IRA, the 529s, and the systematic investing we have set up. Thanks to the great start we got early in our career when running our financial plan I don’t need to allocate much more to traditional investments, which allows me to invest more in what I’d call non-traditional investments—investments outside of the stock market.

An increasing part of my family’s net worth is our business ventures; in 2015 I founded RLS Wealth, a registered investment advisor. I’ve been fortunate to see RLS Wealth grow from just myself to now a team of three. We’re continuing to grow and I expect the team will grow in the coming years. In 2019, I co-founded a private community for financial advisors called The AGC™, which like RLS Wealth is seeing growth—we’re actually opening the doors for more members in January. These are both assets I want to see grow and I am constantly reinvesting back into because as they grow, more families are getting financial plans and more advisors are growing their business, helping more families. I want my legacy to be making a positive impact on as many people’s lives as possible—either directly (RLS Wealth) or indirectly through others (The AGC™). As these businesses grow it will also give me the opportunity to be more charitable. I want our family to be in a position to help other families out whenever it is needed–I have less interest in donating to charities. I want to be able to write checks to people, give cash, or make a contribution to Go-Fund-Me campaigns.

In addition to RLS Wealth and The AGC™, I’ve begun working with other financial advisors helping them with developing personal brands and telling their story, created an online course (with more to come), and have established a couple of brands, All About Your Benjamins and The Advisor Of Tomorrow, all of which could eventually become bigger parts of our “portfolio”.

The final business component to our family portfolio, and the most impressive, is my wife’s business, Roman & Leo, a boutique for little boys. Ang started R&L in 2014 with savings she had from her days in new home sales. She bootstrapped the business on her own, never taking on any debt, and now has a well-known store and online presence that has helped little boys across the globe look stylish.

I’d love to add more brands to our portfolio in the coming years—we’ll see what happens.

There’s one final asset class I’d like to add to our portfolio—private companies. I want to be in a position to invest in my friends or companies I believe in. The motivation behind this is not the potential payoff down the road (that would be the cherry on top), but to support people and companies I believe in. I recently made my first investment in a company I am excited about and who’s CEO I believe in…I can’t wait to be able to publicly share. This is the area I’m most excited about investing in the future.

The rest of our portfolio and plan is pretty straightforward. We have two checking accounts—one for fixed expenses (bills) and one for our monthly variable spending (groceries, entertainment, etc). Each month we set the accounts with their monthly “allowance” and watch as we spend it down. We do use a credit card to get airline miles, but I pay the balance off each week to make sure we don’t overspend or to at least be aware of the months we spend a little extra. Given that we have tons of miles built up, I’m honestly considering moving to another credit card, the Apple Credit Card, and not caring too much about the points game anymore.

We have our emergency fund at an online bank, along with the boys’ savings account, travel savings, tax savings, and house savings. I like to see our savings broken out and not lumped together. I’m looking at moving all our banking away from a big national bank to a local bank and establishing an actual private banking relationship—I’ll probably still keep the online accounts or at least some of them.

We have term life insurance policies for Ang and me. I have a disability policy through the FPA. We have our wills, POAs, and trust. We have a mortgage on our house, which I’m not in any rush to pay off; I actually want to refinance (we’re at 3.125% and have about 17 years left), but my wife likes seeing that we are finally paying more principal than interest, so we’ll keep it. And we have one car loan.

Everything in our financial plan is accounted for, has a purpose, and is designed to help us live the life we’ve determined we want for our family. I have very little stress when it comes to finances because I know we have a plan and I know where to make adjustments if ever needed. I also have very little financial stress because I know I’m in control—no one can take away our financial security, it’s all on me and I’ll bet on myself 11 times out of 10.

Before publishing this, I shared the stories I planned to write with my dad, just to make sure he would be ok with letting readers into his life. Naturally, he said yes, but he shared a little more about why he did the things he did earlier in his career. His goal was to make my sister and my life better and easier than his—and that was the same goal for his father. He wanted us to come out of college without debt (I took over one of my loans as soon as I could, which I am so glad I did) and to have a clean slate to get started building our lives.

He accomplished his goal—my sister is a tremendous teacher and has a beautiful family. I’m doing things I never imagined I would be doing and it’s not only because of his and my mom’s sacrifices to give me a head start but because of the lessons he probably didn’t even realize he was teaching me when I was young.

And now, it’s my turn—it’s my turn to make Roman, Leo, and Silas’s lives better than mine, which I have no complaint and my life has been pretty damn good. It doesn’t mean setting them up to inherit a bunch of money. Instead, I want to teach them how to save, about investing, and encourage them to build—to become entrepreneurial in the way they approach life. We already talk about this all of the time.

It’s impossible to thank my parents enough for the example they set, the sacrifices they made, and the unintentional lessons they taught which have allowed me to create a fulfilled life, understand my purpose, and hopefully be just as good of an example to Roman, Leo, and Silas.

I can’t encourage you enough to grab a copy of How I Invest My Money, not because you’ll find some hot stock or investment tips, but because you’ll read the stories that have shaped the financial plans of some of the best and brightest in finance. You’ll also learn there’s not a “right” way to manage your finances. Instead, it’s important to have a plan that’s right for YOU.

Grab your copy of How I Invest My Money here.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.