Today I tweeted out and shared on Instagram a preview of the first episode in a new series on All About Your Benjamins The Podcast I’m calling The Live Longer and Prosper Series; when I decided to start a podcast, I originally wanted to call it “Live Longer and Prosper” to combine my passions for finance and fitness. But, I decided to keep things consistent and simple, so I went with AAYB The Podcast. I’m excited to bring the name back for the series of podcasts.

The Live Longer And Prosper Series will be a special series of conversations discussing various areas of health, nutrition and fitness. You may be wondering why a financial podcast would include these topics, so allow me to share the why behind the series…

Financial Planning

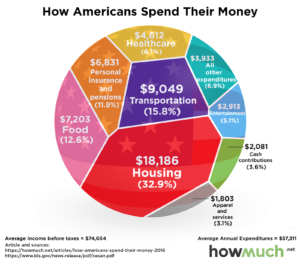

While a financial plan does not have a dedicated section for health, the cost of healthcare leaves a significant imprint on financial planning.

- Healthcare expenses, whether they are insurance premiums, medical bills, or prescriptions, are typically one of the most significant expenses in a household budget.

- Baby Boomers are working longer to stay on employer health insurance plans to avoid having to get more expensive (and less coverage) personal insurance.

- More Americans are suffering from medical conditions like diabetes, obesity, heart disease, and cancers which are tied to poor nutrition leading to higher than average healthcare expenses.

- Healthcare expenses have a higher inflation rate than most expenses in a household budget.

There is good news though; many of the medical conditions leading to higher healthcare expenses can be controlled, or even eliminated with better nutrition and more exercise. When planning for retirement we save, invest, pay down debt and sacrifice to make retirement a reality, but we should also incorporate taking better care of ourselves to help keep retirement healthcare expenses lower.

In addition to the financial benefits of better health, focusing on health and nutrition can lead to a better quality of life. What good is it to save and prepare for retirement if you are not in good enough health to enjoy it?

Personal Interest

If I’m not reading about finance/business/entrepreneurship, I’m reading about health and nutrition, and fitness is a huge part of my daily routine. These are topics I enjoy discussing and look forward to sharing with listeners; while I blog and podcast for the benefit of my audience, I also want to enjoy the subject matter at hand.

The Live Longer and Prosper Series is a bit of an experiment—an effort to find out how to incorporate health and nutrition into financial planning to help reduce current and future healthcare expenses, which is a positive for a financial plan and to improve quality of life when we reach retirement. Who knows where this series will take us, but I’m excited to see where we go and look forward to taking this joinery with you all.

Be sure to check out the first episode of The Live Longer and Prosper Series this Tuesday!

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimer page.