Some perspective on the market today:

- Dow loses 372 points

- S&P 500 loses 43 points

- Nasdaq loses 158 points

At first glance, those are some pretty big numbers; they will definitely grab the attention of investors who have relaxed thanks to the markets relatively calm behavior over the last year. As the often quoted in my writing Josh Brown points out in his post today, it’s been 215 days since we’ve had a 5% pullback in the market–a link to his post can be found below.

Before panic sets in, a 300 point drop in the Dow today is not what it used to be. Most investors suffer from recency bias, which means they believe what has happened recently is likely to happen again. While it’s been 9 years since the 2008 crash, it still weights on investor’s psyche–just look at the record levels of cash still sitting on the sidelines. When investors experience a day like today, they immediately go back to the doom and gloom days of the Financial Crisis. I am usually hesitant to say this, but “this time is different”.

Without getting into the reasons for today’s losses, this time is different than 2008 because a 300 point loss in the Dow is only a 1.78% loss–the Dow sits at 20,606. In 2008, a 300 point loss would have been a 3%+ loss, depending on when it occurred–the Dow sat between 8,000-10,000. So while 300 is a “big” loss in terms of numerical value, it is a normal daily percentage move–there came a point when investors didn’t bat an eye at a 100 point down day.

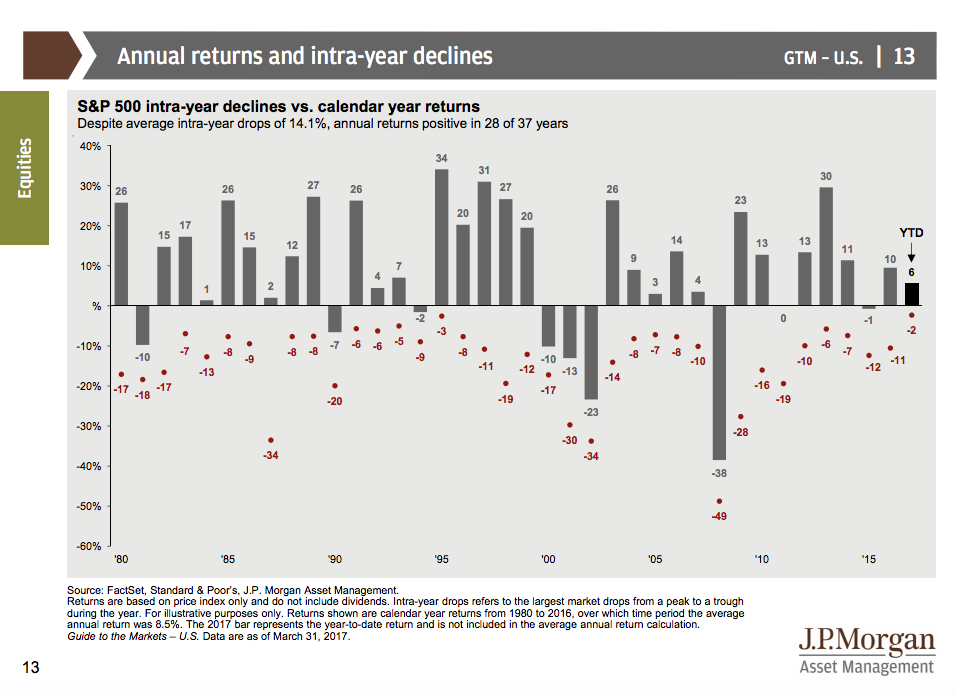

Whether or not today is the beginning of a larger decline remains to be seen. Should the market continue to decline, it would not be out of the ordinary; as the chart below shows, since 1980 the market has experienced a decline during each year, with an average drop of 14.1%. It’s cliche, but we’re overdue for a correction, and we most likely won’t see it coming.

Days like today are good for investors.

Days like today serve as a reminder that investors are compensated for taking on risk; without days like today they would not receive the returns needed to reach their goals. Days like today serve as a reminder of the importance of an investment strategy tied to a financial plan; having a plan and an investment strategy make it easier ignore the day-to-day moves of the market because the focus is on the long term. Finally, days like today serve as a reminder that the financial media exists to sensationalize and sell ads; non-financial news channels had a Dow ticker up today–they usually don’t. One more day like today, and it’ll be “Markets in Turmoil”.

No one likes to see down days in the market, but it is a necessary part of the game we play as investors. As the markets continue to grow over the long term, 300 point down days will turn in to 500 point down days and then 1,000 point down days. Don’t let the numerical value shock you, and don’t overreact to a single day’s move.

Read More:

The Reformed Broker: You Don’t Even Know What A Correction Is

A Wealth of Common Sense: The Expectation of Losses

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “300 Ain’t What It Used To Be”

Comments are closed.