“Investors have become conditioned to assume that every stock market sell-off lines up perfectly with a financial crisis. While you can never rule out a full-blown panic because of investor emotions, reflexivity, or an unexpected event, we don’t have to experience a 2008-level crisis every time there’s a correction or bear market.”

-Ben Carlson, A Wealth of Common Sense Blog

It’s like Ben Carlson read my mind, which we know is impossible for at least two reasons. First, I’m not sure minds can actually be read. And secondly, Ben Carlson has no idea who I am. But we were on the same wavelength regarding the current market’s behavior, and the anticipated outcome(s).

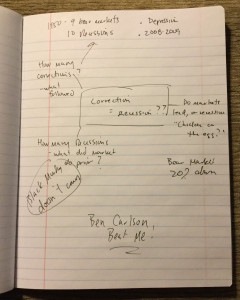

I have a notebook that I use to organize my thoughts for my blog, and one of the pages addressed the question in the title. As I began to research the topic, I came across Ben’s most recent post on his blog, A Wealth of Common Sense, and it was everything I had intended on writing. So, rather than reinvent the wheel, I thought I’d just share the link to his post.

Only time will tell if the economy continues to grow–slowly, or if it stalls and falls into a recession. But don’t be so quick to assume that a correction in the market will always lead to a recession. Remember, we had Markets in Turmoil last fall, and we emerged without a recession.

Kudos to Ben on a great piece.

A Wealth of Common Sense: Stock Markets Sell-Offs Without A Recession

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.