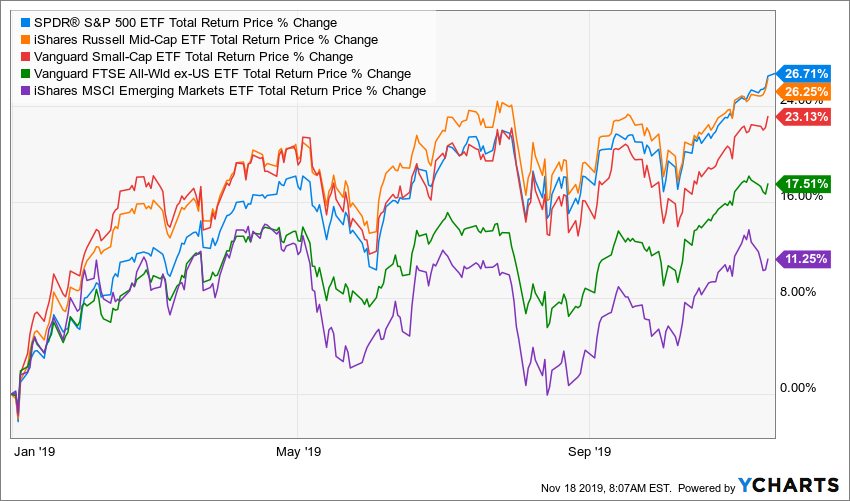

The Dow just broke through 28,000 (for now). The U.S. markets measured by large, mid, and small-cap stocks are all up over 20% in total return heading into the final few weeks of the year. Apparently, there are some “positive” conversations going on between the U.S. and China–at least that’s where we are in the cycle of good talks-bad talks-threats-new tariffs-good talks. It’s times like these that SOMETIMES investors begin to chase waterfalls returns–remember Bitcoin in 2017!?!

Human nature makes investing difficult sometimes and when investors feel like they missed out, or aren’t doing as well as they should, they often make changes they wouldn’t in normal circumstances. Maybe it’s dropping international exposures to overweight the U.S. (watch out for home country bias). Maybe it’s reducing bond allocations to put more into equities. Maybe it’s moving money that has been sitting on the sidelines missing this year’s run and dropping it into the market. Whatever it might be, and these are only a few of the reactions investors may have, the decisions made due to FOMO often ended up hurting in the long run.

Now, I’m not calling a top in the market and I don’t see the stereotypical euphoria in the streets, but I also have been doing this long enough to know that the timing of the year–think holiday parties and get-togethers–combined with the chart you see above typically leads to conversations about performance. And those conversations can lead to doubt, feeling as if you’re not doing as well as you should, and the desire to switch things up.

Those feelings may be right. But, they may not.

Before you make any changes to your allocation, may I offer a few suggestions:

- Review your financial plan and the goal for your investments.

- Review your risk tolerance.

- Talk with your financial advisor about your feelings and the changes you are looking to make.

- Remember it’s ok not to get the highest return possible–with more return comes more risk.

- Finally, remember your plans and goals are different than those you will talk to and may not require the risks they are taking.

- Oh, and people lie.

Enjoy the holidays. Enjoy your family and friends. Enjoy the gains you HAVE made this year.

Just don’t cause yourself harm chasing returns—and please don’t consider this investment advice; talk to your financial advisor!

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimer page.

2 thoughts on “Don’t Go Chasing Waterfalls”

Comments are closed.