If I want to make it from a wannabe to a true financial blogger, it’s imperative that I have a Dow 20,000 post in my archives! There will be no shortage of coverage of today’s milestone…my hope is to put it into perspective for my readers.

It’s the day CNBC, newspapers/magazines, and financial pundits have been waiting for since late last year….Dow 20,000!!! Now that it’s here, let’s take a closer look at what it means to the average investor.

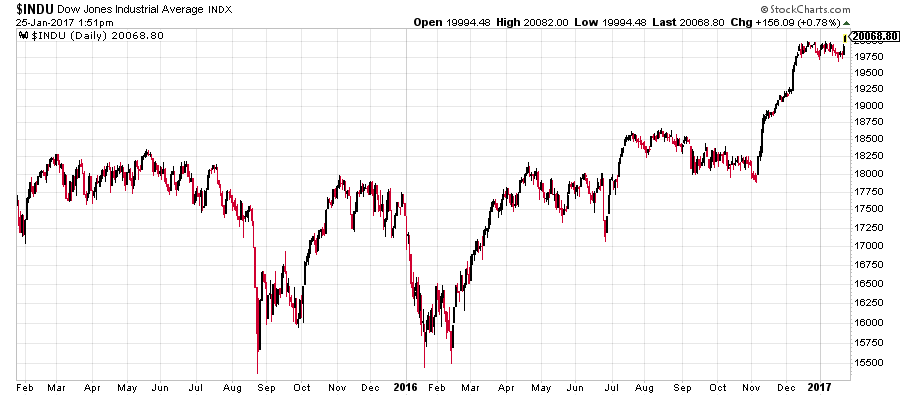

Source: Stockcharts.com

First, let’s look at the numbers…today’s close for the Dow at 20,068.51 represented a 0.78% increase over yesterday’s close. Nothing too exciting. It just so happens that the 155.80 points gained took the Dow over 20,000. While there is nothing special about a 0.78%, or 155.80 point daily gain in the Dow, there is something magical about a close over 20,000.

Dow 20,000 is more of a psychological event, than it is a financial event. Crossing a milestone like Dow 20,000 gives investors a boost in confidence; they feel better because they’ve seen the index gain 1,000 points. They are now looking at a Dow starting with a “2” instead of a “1”—it just seems a lot higher with a “2” in front. And, it just feels good to see 20,000 on the TV. With this boost in confidence, don’t be surprised to see investors who’ve been sitting on the sidelines looking to get back in the market. I’ve already received an email from a client who decided to get more conservative prior to the inauguration stating they are considering getting back into the market…the power of Dow 20,000.

For financial advisors, Dow 20,000 is not as big of a deal; it’s another day with a little more excitement on CNBC and in the headlines. We continue with our clients’ financial plans and investment portfolios just the same as if the Dow was at 18,000 or 19,000. The focus remains on our clients goals and the investment strategies put together to help reach those goals. The investment component of the financial plan is geared for the long term, not short term events like milestones in the indices. It’s fun to witness the Dow break 20,000, but it doesn’t impact our daily activities.

I thought it would be fun to put together a list of statistics, facts, and a couple of opinions regarding today’s milestone.

Dow 20,000:

- Our friends in the media love milestones like Dow 20,000 because they know it will grab the viewer’s attention. It’s a bull market’s equivalent of “Markets in Turmoil”.

- This was the second fastest 1,000 point rise in the Dow, taking 42 days. The fastest took just 24 days when the market rose from 10,000 to 11,000 in 1999.

- To no surprise, Dow 20,000 tells us nothing about the future.

- You know the saying a dollar today, isn’t a dollar tomorrow? Well, I hate to burst the bubble, but 1,000 points today isn’t the same as 1,000 points was in the past. The law of diminishing returns, which says each 1,000 point gain will continue to lead to a percentage increase at a decreasing rate, (huh?) is in full effect. Let me give you an example, 1999’s 1,000 point move represented a 10% gain in the Dow, while the move from 19,000 to 20,000 only represented a 5.3% gain. Our next 1,000 points will represent a 5% gain. As we continue to increase in 1,000 point increments, the percentage gained increases at a slowing (diminishing) rate (from 10% to 5.3% to 5%…). Eventually, we will get to the point where 1,000 point moves won’t be a big deal. It’s hard to believe, but it’s true. Remember when 100, or 200 point moves where exciting, or scary depending on the direction? Today nobody bats an eye at a 100 point move.

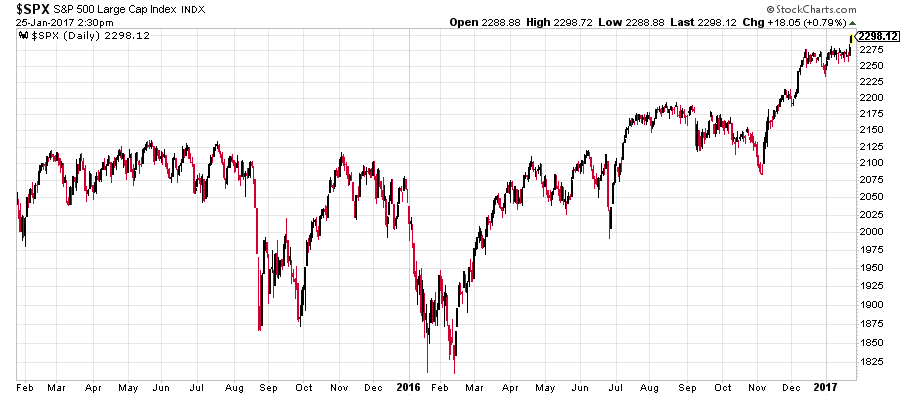

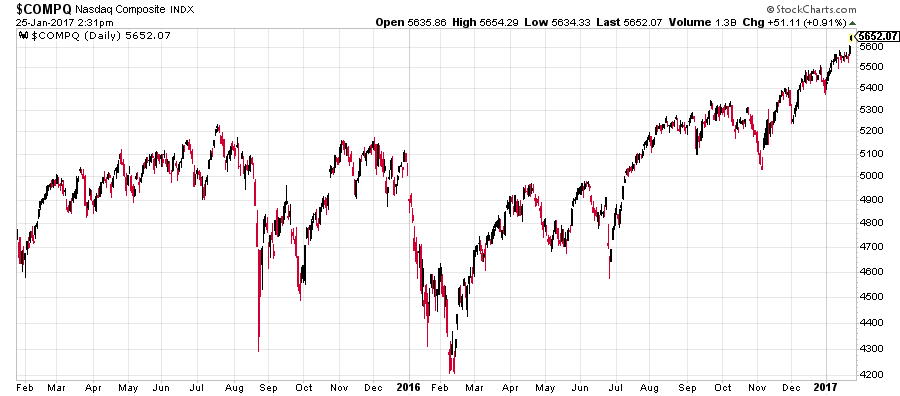

- In addition to the Dow’s all-time high close above 20,000, the S&P 500 and Nasdaq also sit at all-time highs, as represented below in the two charts. Although the Dow gets the majority of the spotlight, it’s important to see the other indices keeping up.

- It’s not just the US markets breaking out; as my friend Josh Brown points out, it’s a global phenomenon. The Entire World Breaks Out

- Stocktwits has released a Dow 20k T-shirt, you can get yours here.

My goal today was not to dismiss the importance of Dow 20,000, rather to keep it all in perspective.

Dow 20,000 is a historical event; in the future, we’ll look back and remember January 25, 2017 as the day we crossed 20,000. Dow 20,000 brings additional confidence to investors, it also removes the fear of Dow 20,000 becoming a ceiling (aka resistance) the market cannot breakthrough, sending the market lower–both important for the trend to continue. With all of that being said, Dow 20,000 does not put investors in a position to reach their goals sooner. It’s just another green day on the chart, and another move towards a new all-time high.

For long term investors, today should just mark another day–another day, another dollar.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.