Earlier this year I wrote about home country bias and how most investors suffer from it. I’ll skip the summary–you can read the post via the link below, but I thought it would be worth revisiting now that the 1st quarter is over to see if investors with home country bias are still missing out.

Before I show this chart, we need to cover something…this is not a recommendation to start chasing returns and put all of your money into international stocks. This is a reminder of the importance of a GLOBALLY diversified portfolio…if you’re not sure about your international exposure, have a conversation with your financial advisor!

Ok….

If you’ve been a homer and stuck with a U.S. dominated portfolio the last few years, you’ve been ok–you’ve actually benefited from your bias. But, that may be changing.

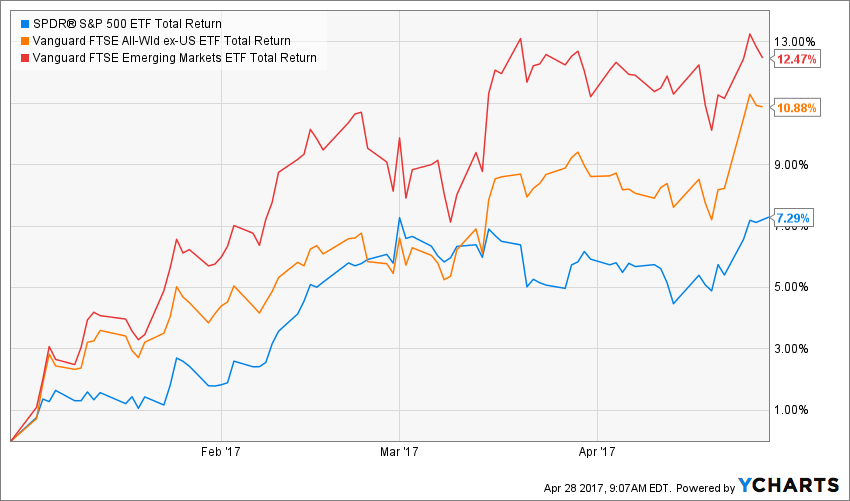

As you can see, while the U.S. market, represented by SPY (blue line), is having a great start to the year, International ex-US, represented by VEU (orange line) and Emerging Markets, represented by VWO (red line) continue to outperform us. Interestingly enough, I am not hearing, or reading much about this…probably because the U.S. market is still doing well, but nonetheless your portfolio may be missing out.

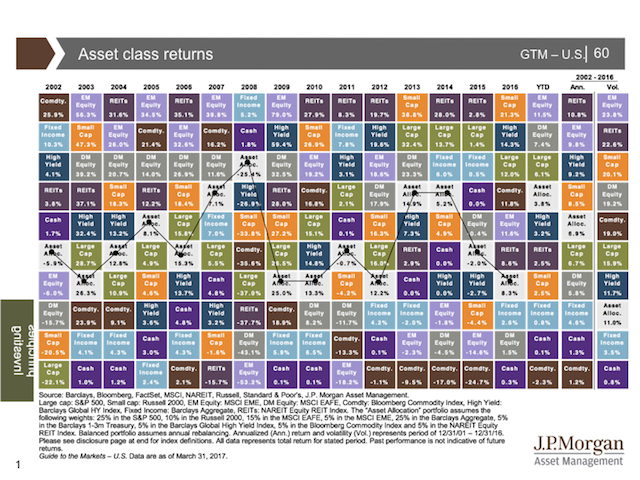

I’ll leave one more chart for you…it’s a classic and continues to support the need for a diversified portfolio, which includes an international exposure.

Will this continue? Who knows.

Should you have international exposure. Yes.

How much? Depends. This needs to be discussed with your financial advisor.

Additional Readings:

All About Your Benjamins: Home Country Bias and Your Portfolio

361 Capital: Home Country Bias at an Inopportune Time

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.