My fellow Millennials, it’s time we have a heart-to-heart about retirement. If you are planning on working for 30 years and then retiring, it is time to reassess those goals. Our retirement is going to be much different than the generations before us.

Old Retirement = Pension + Social Security+ Savings

Here are the facts:

Life expectancies continue to rise: According to the Social Security Administration, the average life expectancy for males reaching 65 is 84.3 years old, and for women reaching 65, their life expectancy is 86.6 years old. Thanks to the advancements in healthcare, and a greater awareness of our well-being, this number will continue to rise. We should be planning to live well into our 90’s and possibly 100’s. Are you prepared to provide, or at minimum supplement, your income for 40-50 years?

Pensions are an endangered species: Most Millennials will not be afforded the privilege of a pension like our grandparents, and maybe our parents, have been. Unless you are a teacher, government employee, or veteran it is highly unlikely that your company will provide a monthly check throughout retirement. If you do currently have a pension, it may not be there when it comes time to collect it. What does a lack of pension mean? It means you will need more in your nest egg to replace the income a pension would have provided–plan on needing an additional $750k-$1M in your retirement savings.

Social Security needs an overhaul: This isn’t to say that Social Security won’t be around when it is time for us to collect, but I’m not certain what it will look like. If it maintains the current format, the retirement age for collecting will need to be adjusted upward to take into consideration the longer life expectancies. Since there is uncertainty about our Social Security benefit, it is prudent to plan for retirement without it, until we know what it will look like. It would be unfortunate to plan for Social Security under its current form, only to have it changed a few years from retirement and have your plans wrecked.

New Retirement = Continued Work + Savings + Social Security (in some form)

We are going to have to work later in life. Depending on how you plan, it could be continuing with the career you’ve held for 30 years, or transitioning to a second mini-career that is more enjoyable and less stressful. But, nonetheless, plan on working beyond 55 and 65.

We are going to need to save more. How else will you make up for no pension? The good news is we have more time to build the nest egg that will be necessary for retirement.

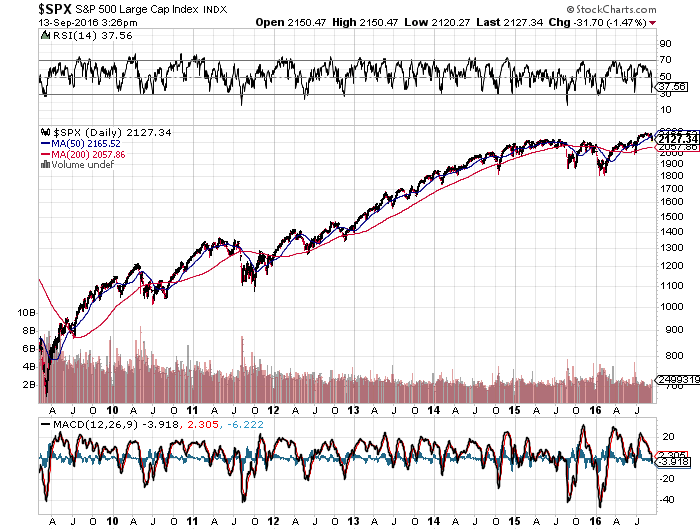

We are going to need to invest. Yes, there is risk to investing. But, there is also risk to NOT investing…mainly, inflation. Oh, and don’t forget missing out on the power of compounding interest. Many Millennials remember the Great Recession and the stock market losses experienced in 2008, and unfortunately, while many remained on the sidelines, spooked, and not invested, they missed this:

Source Stockcharts.com

I have yet to find a better opportunity to accumulate wealth than investing in a diversified portfolio of low cost investments. It’s the only chance to stay ahead of inflation, and the only chance to accumulate the wealth needed for retirement. Because of this, it is critical to develop an investment plan and stick to it.

We have a choice…we can complain that we are going to have to work longer, or we can embrace it and begin planning for the future. I choose to embrace it, plan to continue in a profession that I love well into my 70’s, and find a good balance between preparing for the future and enjoying today (a blog post topic coming soon). What do you choose?

Sources:

Social Security Calculators: Life Expectancy

National Institute on Retirement Security: Pensions

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.