“DIVERSIFICATION MEANS ALWAYS HAVING TO SAY YOU’RE SORRY” -Brian Portnoy

This is one of my favorite investment quotes, and while I’m not sure who said it first, I am going to give Brian Portnoy credit since I read it in an article he wrote back in early 2015 (link below). As I prepare for upcoming meetings with clients, I can’t help but to think about Brian’s genius quote; I’ve been reviewing individual portfolio performance for the year, quarter and during the “Trump Rally”, and while I’m happy with where my clients’ portfolios sit, I know there will be a few who question why their portfolios are not higher given the returns in the “market”.

The answer is simple, diversification.

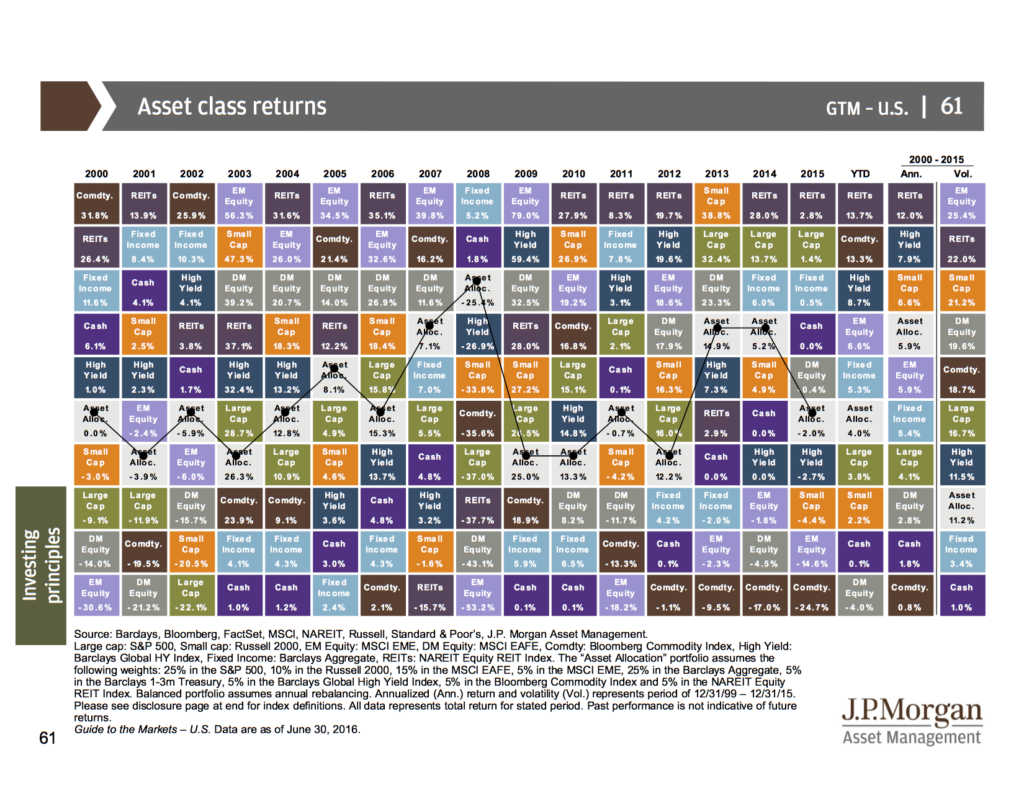

One of the first principles taught to an investor is not to put all of their eggs in one basket. Diversification, the practice of spreading our investment eggs around, is a strategy to gain exposure to different asset classes, sectors, countries, etc. in order to reduce the risk of a portfolio. The periodic table of investment returns, produced by JP Morgan in the 3rd quarter 2016 Guide to the Markets, shows the randomness of asset class returns over a long period of time (15 years).

Diversification takes the guess work out of investing, and while the benefits of diversification are often explained, the opportunity cost of diversification is often skipped over, until it shows up on performance reports. In a diversified portfolio, investors will participate in the top performing asset class, but they will also participate in the worst performing asset class, along with everything in between. The participation in the second best to worst asset class will insure that a diversified investor will not be able to outperform the top performing asset class. Take a look at the light gray shaded Asset Allocation boxes on the chart above–see how they are never at the top, but are also never at the bottom? That’s diversification at work.

Rarely is diversification questioned, except for when a single asset class significantly outperforms the others–the questioning usually occurs when large cap U.S. stocks outperform, as measured by the S&P 500, since this is the “market” that is often referenced in the media. When investors hear on the news that the S&P 500 is up X% for the year, but their portfolio is only up Y% for the year, it is not uncommon for them to question why.

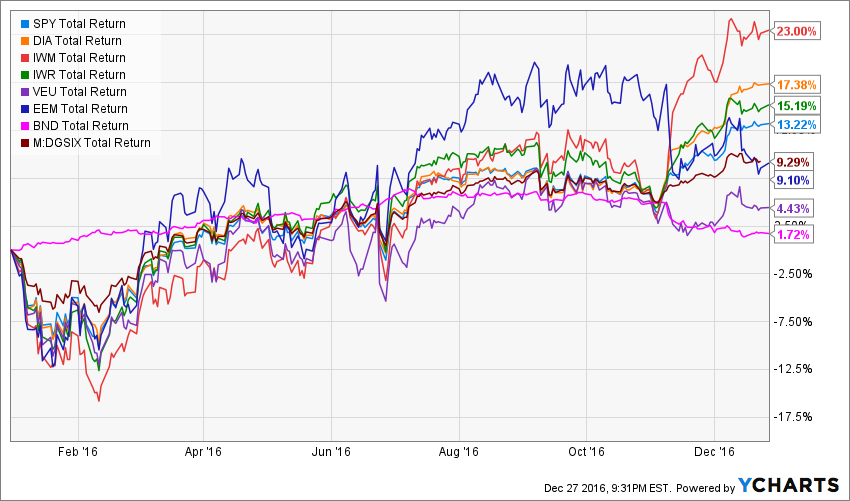

With the S&P 500 up over 13% and the Dow Jones, nearing 20,000, up over 17%, 2016 will most likely be a year diversification is questioned, leaving advisors apologizing for doing their job–just take a look at the chart below.

The chart shows the year-to-date total returns for different asset classes measured by their corresponding ETFs, along with Dimensional Fund Advisors’ 60/40 Global Asset Allocation mutual fund to represent a diversified portfolio. Note: A diversified portfolio could be any breakdown between stocks and bonds; the result will be the same–the diversified portfolio will not be the top performer. While I enjoy looking at the moves of the various asset classes throughout the year, the chart can be a bit overwhelming, so I’ve created as simplified table.

To no surprise, the returns of the different asset classes tell the same story of random returns as the chart from J.P. Morgan–even down to the diversified portfolio hanging out in the middle of the pack.

The total return of the diversified portfolio (DGSIX) should make investors happy. But, when it is trailing the S&P 500 by 4%, and the Dow by 8%, inevitably there will be investors disappointed to be trailing the “market”. Lost in the disappointment, is the understanding that the diversified portfolio is taking on less risk than a portfolio invested 100% in the S&P 500, or any single asset class. While markets do well, the reduced risk is under appreciated, and sometimes seen as a hinderance to the portfolio. However, as soon as the market fizzles, or a normal correction occurs, diversification is once again appreciated. If only we had that magical crystal ball…

It’s natural for investors to compare their personal portfolio to what is reported on the news. And the longer the markets rally, it becomes easier for investors to forget why they have a diversified portfolio…anyone remember January and February of this year? Go take another look at the first chart I shared…DGSIX doesn’t look so bad back then.

At my firm, I spend a lot of time educating clients on the portfolio construction process, why we hold globally diversified portfolios, and what that means in both good and bad markets. While I don’t expect too may questions in my upcoming meetings, I know there will be a few, and it’ll be another opportunity to revisit investment policy statements, financial plans, and the overall goal for why we are investing. I have no problem apologizing for not outperforming the S&p 500, or the Dow, or the small caps, or the mid caps, or any of the other single asset classes. I’m not willing to take that kind of risk with my clients.

If you’re feeling disappointed with your portfolio, schedule some time to meet with your financial advisor to review your financial plan, your goals, and your portfolio’s construction. And then, thank your advisor for underperforming…they are doing you a favor.

Brian Portnoy in Forbes: Diversification Means Always Having To Say You’re Sorry

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.