Recently, Barry Ritholtz wrote an article for The Washington Post that asked a simple question, “Do you need a financial advisor?”

I am an avid reader of Barry’s blog (The Big Picture), along with his writings for The Washington Post, Bloomberg and other publications. I’m also a huge fan of what he and his colleagues are doing in the field of financial planning; the highlight of a recent trip to New York was getting to meet him and his team. I bring all of this up because I want to make sure this post is viewed as an extension of his article, not a critique.

In the article, the reader is taken through a series of questions to determine if a financial advisor is needed for their personal situation, or if they would be better off managing things on their own. Instead of asking, “Do you need an advisor?”, I think we should be asking “What type of relationship do you need with an advisor?” because I believe everyone can benefit from working with a financial advisor. The key is finding the right type of advisor offering the services that are best fit for your situation. My goal is to present the different types of financial advisor relationships to help you decide what type of financial advisor is best for you:

I. The AUM Relationship (note: AUM stands for Assets Under Management, referring to the compensation structure for the advisor, typically around 1% (give, or take a few basis points) of the assets being managed).

The AUM relationship is quickly becoming the most common relationship with a financial advisor thanks to the growth in Registered Investment Advisor (RIA) firms. The increase in RIA firms and advisors adopting this business model is a positive for a number of reasons. First, advisors operating under the RIA model and charging an AUM fee are fiduciaries, meaning they are required to put the client’s interests first (Here is an older post where I cover why working with a fiduciary is what individuals should strive for in financial planning). Advisors operating under other models are not necessarily held to the fiduciary standard (for now) and are open to various conflicts of interests. The removal of conflicts of interests is critical in building a solid foundation for a long term relationship with an advisor, and the AUM relationship accomplishes this.

The AUM relationship is also the most comprehensive relationship with a financial advisor–meaning the advisor is providing financial planning and advice in all areas, along with investment management. A true financial advisor will review, advise and recommend on not just investments, but retirement planning, estate planning, tax planning, insurance planning and any other planning goal important to the client. If your current advisor is not advising you on these areas and you are paying an AUM fee, you might want to revisit your relationship because you are most likely over paying for basic investment management.

As previously mentioned, the AUM model is growing and will continue to do so; not only because of the passage of the Department of Labor’s Fiduciary Standard, but because more advisors are realizing there is a better way to work with clients, and clients are expecting more from advisors than basic investment management.

Typical AUM relationship clients: High net worth, Baby Boomers, delegators, families with complex planning needs.

II. The Retainer/Subscription Relationship

While the AUM relationship continues to grow at a fast rate, the retainer/subscription, relationship has begun to gain traction. Unlike the AUM relationship, which is based off the amount of assets an individual has, the retainer/subscription relationship is a flat fee. This is an advantage to individuals who have been neglected by advisors in the past because of firm minimums in assets. Financial advisors offering a retainer relationship often provide varying services, so this relationship may not be as cut and dry as the AUM relationship. For example, at my firm I offer a monthly subscription plan that provides a comprehensive financial plan with recommendations and action items, an annual review, investment management, and access via phone and email throughout the year. Other advisors may offer more, or less as a part of their relationship so it’s best to confirm what is included in this type of relationship.

The retainer/subscription relationship allows for individuals looking for a financial advisor, but don’t necessarily have the complexity, or assets to warrant an AUM relationship, to work with an advisor. In the past, these individuals would have been left to work with insurance salespeople, or brokers who often caused more harm than good.

Typical retainer/subscription relationship client: Millennials, High earners looking to start saving, anyone looking to get started in planning, and individuals with asset levels below most firm minimums.

III. The Hourly Relationship

Many other professional service industries offer an hourly relationship–think CPAs and attorneys. The hourly relationship is pretty simple; the advisor charges an hourly rate for his time.

The first two relationships are designed for individuals looking to outsource financial planning…maybe they don’t feel they have the knowledge, or they don’t want to take the time to manage everything, so hiring an advisor to take care of everything is what fits their situation best. The hourly relationship is designed for those who take more of a do-it-yourself approach to their financial planning, but still would like professional advice from time to time. It could be a recommendation for asset allocation that the client then takes and manages herself, or it could be getting advice on how to best structure investments for estate planning. The beauty of the hourly relationship is it is flexible, and it allows the client to seek advice in specific areas, while managing the rest on their own.

Typical hourly relationship clients: Do-it-yourselfers, those looking for very specific advice.

IV. The Fee for Project Relationship

The fee for project relationship is very similar to the hourly relationship, except the cost of service is already set. The most common fee for project is a financial plan. The advisor provides a financial plan with recommendations for a set fee, and the rest is on the client.

This is another relationship designed for the do-it-yourself individual. It is not uncommon to see the fee for project relationship combined with the hourly relationship for any future questions. It can also be combined with the AUM relationship, where the AUM fee is much lower than normal because there is less service being provided–just investment management. Just like the hourly relationship, the fee for project allows for flexibility and for the client to be able to structure the advice received to the specific areas needed. Or, it could just allow for the individual to get a second opinion.

Typical fee for project relationship clients: Do-it-yourselfers, those looking for specific advice, those looking for second opinion.

V. The Commission Relationship

I won’t spend much time here because the commission based advisor will soon be extinct. Despite conversation speculating the repeal of the Department of Labor’s Fiduciary Standard by President-elect Trump, the movement towards client-focused relationships has begun, and it won’t be stopped. Josh Brown, who happens to work with Barry Ritholtz, wrote about this on his blog “I Dare You”, and you should check it out.

As you have probably noticed already, all of the relationships are centered around two things:

- The services provided by the advisor, and desired by the client.

- How the advisor is compensated, or charges his fee–the cost to the client.

The key to finding the right advisor is finding one that meets all of your qualitative requirements, like personality, investment philosophy, trust, etc., and will also provide the type of relationship that best fits your needs. Unfortunately, sometimes the advisor who meets your qualitative requirements may not offer the relationship you are looking for, and your search will continue; however, more advisors are broadening the relationships they offer to be able to better serve clients.

Now back to Barry’s question: Yes, I think everyone can benefit working with a financial advisor. However, not everyone requires the traditional comprehensive financial advisory relationship. Thanks to technology, individuals with the time, desire and discipline can manage their own investments much cheaper than working with a financial advisor in an AUM relationship, but can benefit from a detailed plan with recommendations to carry out on their own.

Younger clients can benefit by working with a financial advisor because the majority of college graduates have little to no education in personal finance. A financial advisor can help develop a plan for managing student loans, begin saving for retirement, saving for college, along with advising on the other needs for a young professional/family. The retainer/subscription relationship makes this possible for those who have been neglected for too long by advisors.

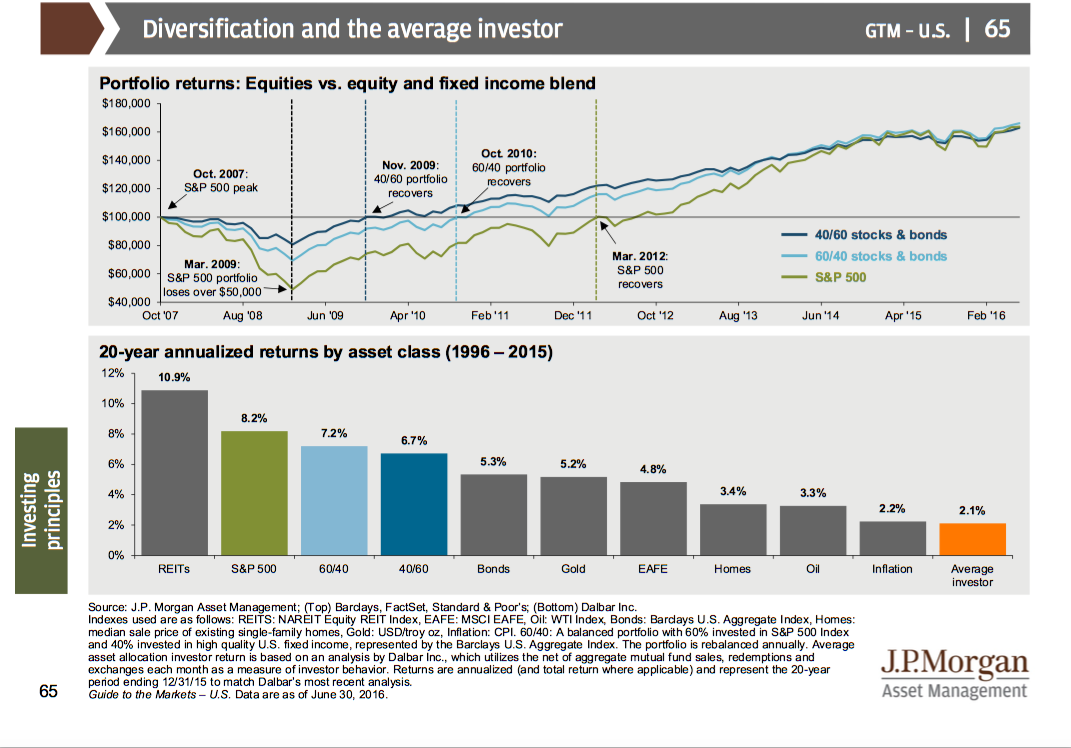

Finally, working with a financial advisor can be beneficial to everyone because personal finance and investing is extremely emotional. If left to our own devices, we will make bad financial decisions. For proof of this, you only need to look at investor behavior. The chart below shows how bad investor behavior, driven by emotional decision making, causes drastic underperformance when compared to a diversified portfolio.

Bad financial decision making is not only constrained to investing; it can be seen in insufficient life insurance to protect a young family. It can be seen in the lack of basic estate planing documents, like a will. It can be seen in irrational spending and borrowing–much like what lead to the financial crisis in 2008. Many of these bad decisions can be avoided by having an objective third party like a financial advisor.

There is not a single “right” relationship for everyone to have with a financial advisor, but there is a “right” relationship for each individual–it’s up to you to figure out which is best for you!

Barry Ritholtz-The Washington Post: Do You Need A Financial Adviser?

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “The Right Type of Relationship with Your Financial Advisor”

Comments are closed.