Every Friday I’ll be releasing my own compilation, a mixtape if you will, of blog posts from the week I think are worth your time.

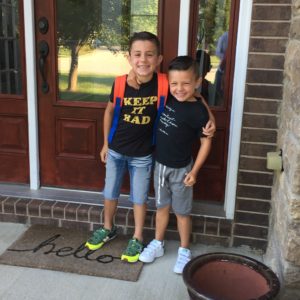

Another big week in my house, the first day of school for Roman. Last week we celebrated his 7th birthday, and this week he’s off to first grade. And yes, I know what you’re thinking–school starts way too early in Indiana!

I am beginning to sound like a broken record, but it was another great week for content. It’s pretty cool we live in a time where we have access to so many great writers, most whom we’d never have the chance to read if it weren’t for technology. It’s almost too much–I could spend all day jumping from blog to blog.

Here’s this week’s mixtape. I hope you enjoy!

Morgan Housel via Collaborative Fund: Why Everyone Should Write I started this blog because I wanted to produce content that could help educate those looking to learn more about financial planning and investing; the jury is still out as to whether or not I’m doing a good job. I quickly realized my writing would also make me a better advisor because it would force me to spend more time reading and researching whatever topic I chose to write about. You better believe I’m double and triple checking my facts/numbers/etc. before I make my post live. Morgan gives us a couple more reasons why writing should become a part of your daily routine.

Corey Hoffstein via The Wall Street Journal: The Problem with Too Much Portfolio Diversification Far too often new clients come into my office with a portfolio of 15-20 funds under the impression they have a diversified portfolio, only to find out the funds they are invested in are highly correlated (meaning they are invested very similarly) and not properly diversified. In this WSJ blog post, Corey breaks down diversification for us; Corey is one of the smartest people I have ever talked to, and yet, he does a great job breaking down complex topics into terms everyone can understand.

Brendan Mullooly: The Meanest Reversion: BABIP and CAPE Back for the second week in a row, Brendan gives another gem regarding stock market valuations and the eventual return to the averages. I’m not a baseball fan, but I really appreciate his analogy, and so did the rest of Fintwit (Finance Twitter) as he had some big name guys share his post.

Carl Richards via Behavior Gap: Massive Incremental Change This one is short and sweet, and even if you don’t listen to the quick conversation you have to visit this one just for the visual.

Inc.com: Why Millennials Are So Entitled Well Millennials, we don’t necessarily have the best reputation with the older generations. Some of the stereotypes are deserved, but the majority of them are off base. Here’s a few of the stereotypes plaguing us–how are you going to prove them false?

The Irrelevant Investor: If This is 1929… It’s a good one.

All About Your Benjamins: The Next Generation of Advisors Make sure to read Ben Carlson’s piece that I’ve linked to in this post.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.