It’s been awhile since I’ve written about ESG investing–don’t worry, I haven’t forgotten about the movement. I’ve been taking my time and reading as much as I can about the investment philosophy, it’s pitfalls, and different approaches to implementing it within a diversified investment strategy. After all, the end goal of my research is to develop portfolios for my clients with an interest in ESG investing. I’m getting closer, but still have a little ways to go.

For those interested in implementing an ESG strategy, or looking for an advisor to help them, I want to share some of the hurdles I am working on clearing. These are issues everyone with an ESG focus should be aware of, be able to discuss and understand their potential impact on a portfolio.

Lack of control

The purest way to build an ESG focused portfolio is to create your own list of companies in line with your values and invest directly into the common stock of those companies. In order to properly diversify a portfolio of individual companies, a fairly large sum of money is needed, and let’s face it, most of us don’t have a seven figure portfolio (yet!!). This leaves investors outsourcing to ETF and mutual fund managers. While there is nothing wrong with leaving the stock selection to the creators of indexes or fund managers, it does leave you at the mercy of those decision makers, and you may find some companies in your fund that would not have made it past your ESG screens.

For example, the iShares MSCI KLD 400 Social ETF (ticker: DSI) holds Coca-Cola and McDonalds as two of its top twenty-five holdings. Or, the iShares MSCI USA ESG Optimized ETF (ESGU) holds Exxon Mobil (XOM) as one of its top ten holdings. Depending on your screening criteria, these companies may not have been ones you would have included, but since the default investment vehicles for most investors, this is something ESG investors will have to accept. A “perfectly in-line with your values” portfolio is probably not going to be realistic, and as an ESG investor you will have to be okay with holding a few companies that may not fully meet your personal screens.

As ESG investing gains in popularity, there will be more options available–may be a a good thing, or may not–and you may be able to get closer to your ideal ESG portfolio.

Different Levels of Diversificaton

ESG screened funds are not different from other funds when it comes to varying levels of diversification–DSI has 404 holdings while, the SPDR SSGA Gender Diversity ETF (SHE) only has 172 holdings. A fund with fewer holdings can lead to individual companies having a greater impact on the funds return–for better, or worse. It’s important to know what you own!

Short Track Records

Socially Responsible Investing (SRI) is not a new phenomenon, but it’s becoming more popular as Millennials and women begin to control more of the investable assets; there is plenty of evidence showing the two demographics are more likely to consider the environmental, social and governance issues ESG investing address. Wall Street, always looking to take advantage of the trends, is busy creating new funds in the ESG space, and these funds may end up providing the opportunity to create a portfolio more closely in line with your values. It also means there is an increasing number of funds with very short track records. If we revisit ESGU, its inception date is 12/1/2016–not even a year old yet.

As a believer in Evidence Based Investing, I might argue the track record of these mostly indexed funds should not make a huge impact on your fund selection–after all, hindsight is always 20-20, and it is not indicative of what to expect in the future. However, I understand investors are not always rational and have a tendency to value past performance, often chasing the best performers so it must be considered. With a short track record, it is difficult to see how ESG strategies, particularly those actively managed strategies, would have held up in different markets, or to see how the investors in the funds would have behaved in turbulent markets (spoiler alert: after conducting my own research, most would have held up like any other diversified equity fund and individual investors would have panicked like normal).

An increasing number of new funds also leads us to our next issue…

Low Liquidity and/or Volume

When using ETFs over mutual funds, ESG investors need to consider two important characteristics:

- Liquidity refers to how quickly you can convert an asset to cash. Cash is the most liquid asset, and real estate, fine art, collectibles, etc. are the least liquid. Every other investment falls somewhere inbetween.

- Volume refers to the number of shares traded amongst investors. A high daily volume means there are a lot of buyers and sellers in the market for the security. A low daily volume means there are fewer buyers and sellers in the market for the security.

Without going into a long, complicated explanation, if you are going to invest in ESG focused ETFs you need to understand how liquid the market is for your investment and what type of average volume it has. A major risk to using a newer fund with low liquidity and volume is there may not be a market (enough buyers and sellers) when you are ready to sell (or buy). In an extreme scenario, like a flash crash, you may not be able to sell, or if you are, you may have to accept a price much lower than you’d like–with fewer buyers and sellers, the person on the other end of the trade has a little more influence over price if you’re in a hurry to sell…supply and demand at its finest.

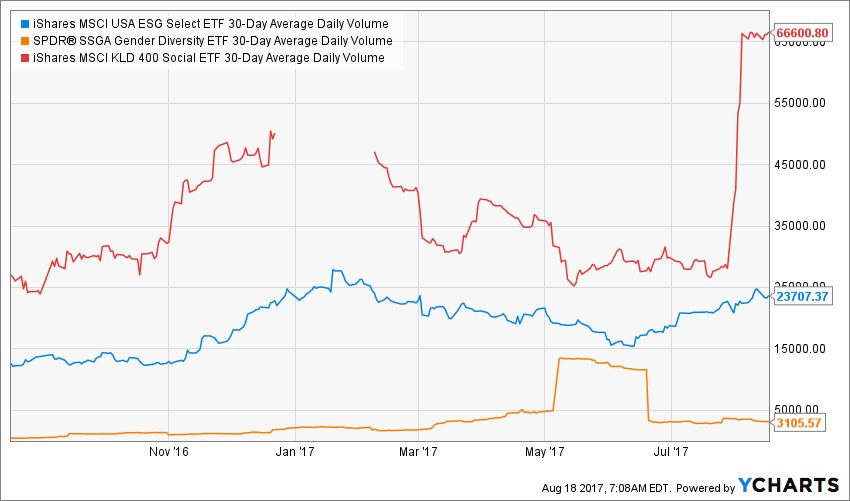

The chart below shows the 30-Day average daily volume for DSI (red), SUSA (blue) and SHE (orange). Which one do you think is easier to sell if you needed to?

You shouldn’t be selling during market panics, so this shouldn’t be an issue…but you need to understand it, just in case.

Potentially missing out on growth from companies screened out

When you narrow the universe of stocks, you ultimately screen out companies with great growth potential. This should lead ESG investors to answer a philosophical question: Why are you investing? Is it to give yourself the greatest possible chance at accumulating the wealth needed to reach your goals? Or, is it to invest with companies sharing your personal values?

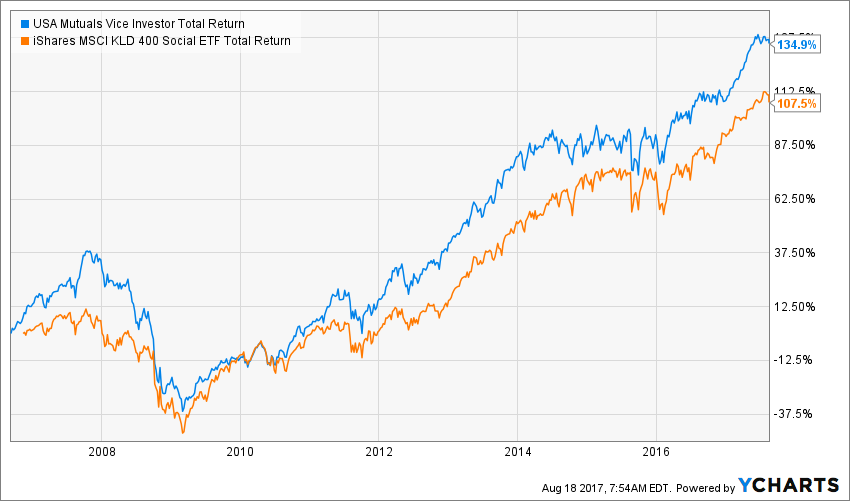

The chart below shows a comparison of USA Mutuals Vice Investor (VICEX) and the iShares MSCI KLD 400 Social ETF (DSI); as you can see, over the last 10 years VICEX, which includes companies considered “sin” stocks–think tobaccos, alcohol, and firearms, has outperformed DSI by a fairly significant margin. We’ll have to wait and see if this trend remains, or if the increased scrutiny of corporate behavior by investors closes the gap.  If you decide the principals behind an ESG strategy outweigh the potential growth of an all-inclusive portfolio, you need to make sure your financial plan reflects an ESG-adjusted expected return.

If you decide the principals behind an ESG strategy outweigh the potential growth of an all-inclusive portfolio, you need to make sure your financial plan reflects an ESG-adjusted expected return.

I’m getting closer to finalizing the ESG focused portfolios for RLWM, and I’ve thoroughly enjoyed the process; I’m excited to roll them out! I’ve come to the conclusion that although there are some hurdles for ESG investing, they should not prevent those with a desire to invest with their values from doing so.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.