Podcast: Play in new window | Download | Embed

Subscribe: RSS

Week In Review Articles

The WSJ: Fed Raises Interest Rates for First Time Since 2018

The WSJ: Mortgage Rates Rise Above 4% for the First Time Since 2019

The WSJ: China’s Covid-19 Surge Shuts Down Plants in Manufacturing Hubs Shenzhen and Changchun

The WSJ: After Walt Disney, Robert Iger Heads to the Metaverse

Weekly Mixtape

A Wealth Of Common Sense: Different Kinds Of Sad “Looking back has been cathartic. It doesn’t take away the sadness but that sadness wouldn’t exist if it wasn’t for all of the fond memories we had with her.“

The Reformed Broker: Don’t Bother Looking, It Will Find You “People who sell it will find you. That’s their job. I know these people. They know exactly what they’re doing. And once they’ve identified you they will prey upon your every weakness. Not only will they convince you that this is how the “real” wealthy people invest, they will set an artificial deadline for you to get the money in to them.“

Ryan Krueger: Yielding Better Results “He had a crazy job offer for his good buddy available – director of program development. Griff had it made in every way after making partner in the law firm making close to seven figures, and a loving wife with the deepest of roots in Houston. He was offered a basketball job, to move across the country for $32,000 a year salary.“

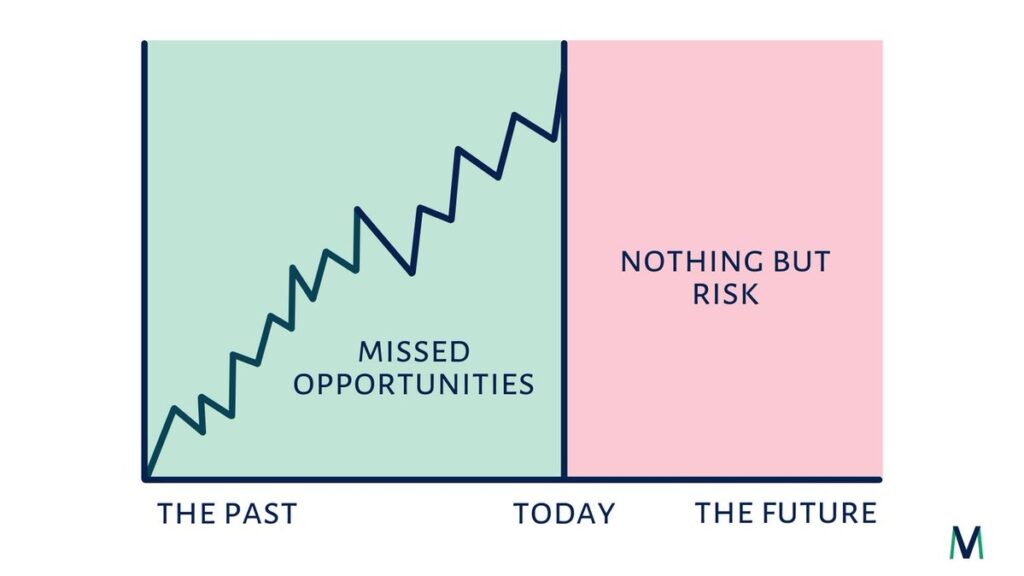

The Irrelevant Investor: It’s Been A Good Run “What you do need is a plan. And nobody who’s selling all their stocks today has a plan because nobody’s plan is to panic sell. If you’re trying to grow your wealth, and I don’t know any other reason for investing, then part of the plan has to include living through discomfort. Any strategy that’s predicated on all upside and no downside is bullshit.“

Of Dollars And Data: Great Depression Or Bust “First, they tend to assume that every market correction is “the big one” though it probably won’t be. And, second, even when “the big one” comes, what’s happening in their portfolio will probably be the least of their worries.“

Cameron Rufus: Lessons From The Bar “Chance was also created to represent all of us. As an economy and emotionally; They each move in cycles. We all have this euphoric period where everything is great and we feel unstoppable. Until real life sets in, we implode, and everything that seemed so sure comes crashing down.“

Jane McGonigal: Mental Time Travel Is A Great Decision-Making Tool — This Is How To Use It “Whatever you see in your future will always come from information your brain has already perceived and processed. Ideally, as you get better at imagining the unimaginable, you’ll incorporate not just obvious ideas and events but also surprising things that could be important in your future.“

The PRST: The Importance Of Confidence

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.