A couple of weeks ago we covered the basics of SRI and ESG investing, why it is becoming a popular investment theme, and why this trend will most likely continue. If you missed Part I, or need a recap, click here to go back to the first post in this series.

Today, I want to build upon our foundation and take a look at how investors can allocate their investment dollars to ESG investing–basically, what are the options for investing in ESG strategies?

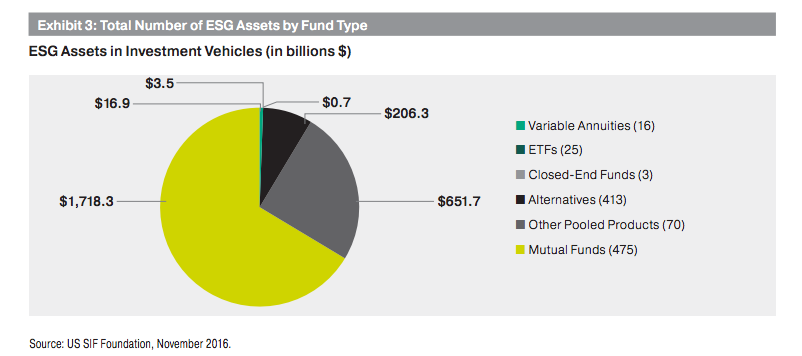

The graph below should look familiar because it was in the previous ESG post; it shows the different investment types with ESG strategies. Based off the variety of options and dollars invested, it’s easy to see Wall Street and the investment community have taken notice of the demand for investments that leave a positive impact.

I’m going to keep the focus on ETFs, Mutual Funds, and individual securities; we’ll omit closed-end funds because there are so few, alternatives & pooled investments because they are usually reserved for larger investors, and variable annuities for reasons I won’t go into today.

Disclaimer: Before we move forward–any of the funds mentioned below are cited as examples. Their inclusion in this post should not be considered an endorsement, or recommendation. At the time of writing, I do not, nor do any of the client accounts I manage, hold any of these funds, and there is no intent to purchase any of these funds in the immediate future. Consult your financial advisor if you are interested in learning more about these investments and how they might play a role in your portfolio.

ETFs

While mutual funds currently hold the title for the largest number of options, I expect to see the ETF market grow in the coming years. The trend in the industry is moving toward low cost investments, which is the ETF market. The ETF options should continue to grow not only because of their cost advantage, but also because they are more transparent, meaning it is easier to see what companies the fund is actually holding. Mutual funds disclose their holdings, but it is delayed and is backward looking–you never really know exactly what you own.

Another advantage the ETF market has over the mutual fund market is ETFs have the ability to be very specific in their investment theme. For example, if your interest is in clean water there is an ETF investing in companies that deal only with water, PowerShares Water Resources ETF (ticker: PHO). Or, maybe you are interested in investing companies that support gender diversity in the work place, the SPDR® SSGA Gender Diversity ETF (ticker: SHE) could be an option for you. Although ETFs are diversified in their structure, meaning they hold many stocks, choosing a specific themed ETF may increase your overall risk because you are limiting the universe of companies to choose from.

In addition to the niche ETFs, there are broader based ETFs like iShares MSCI USA ESG Select ETF (ticker: KLD), which tracks an index of stocks that have positive screens for ESG factors. These ETFs are going to look more like the mutual fund options available, but again, will tend to be lower in cost because of the passive index approach to the fund’s management.

It’s important to make sure you understand how the fund determines the companies included, the overall strategy of the fund, and how it fits into your portfolio. It’s always important to understand what you own–even more so when you start including very niche ETFs. If you’re interested in learning more about the different ESG ETFs available, do a quick Google search and you’ll be able to find a list of ticker symbols to begin your research.

Mutual Funds

Mutual funds have a longer track record with SRI and ESG investing, so if you like to see a longer track record, mutual funds may be the option for you. Like their ETF cousins, mutual funds are going to be diversified investments using different ESG screens to determine the companies included in the fund. While most ETFs are relatively passive, meaning there is not an investment team attempting to pick stocks to beat the markets, mutual funds come in both the active and passive form. If you are a believer in active management, then for the time being, looking into the mutual fund offerings will help you find the funds that fit your investment philosophy; I say for the time being because active ETFs are being introduced daily, and it will only be a matter of time before there will be an active ETF version of the mutual fund.

Individual Stocks

Evidence suggests this is probably not the best route to go–stock picking is increasingly harder and harder to do successfully. Unless you are looking to invest in a specific company with a portion of your portfolio you can “stand” to lose, ETFs, or mutual funds are probably the better choice to implement your ESG strategy. Individual stocks should probably be more of a compliment to your diversified portfolio and not make up the core of your portfolio.

Picking The Right Funds

As you begin to evaluate if ETFs, mutual funds, or individual stocks are the best investment option for your goals, it is important to understand the following:

- What are the ESG screens used to determine which companies are included?

- What is the fund’s benchmark?

- What is the fund’s expense?

- How does this ESG investment fit your overall investment portfolio?

- Is your ESG investment too risky given it’s investment theme?

The bottom line is know what you own. As the ESG movement strengthens, there will inevitably be funds marketed as ESG, but will barely fit the direction; ESG will become a marketing tactic to gather assets–very similar to the way the “natural” label on food has grown to be meaningless. Understanding your investments will help avoid the poser funds that will come.

Putting It All Together

Now that we’ve identified the most common types of investments to implement an ESG strategy, the next step is to determine how to best construct a portfolio of ESG funds.

- Is it a diversified portfolio of only ESG screened funds?

- Is it a mix of ESG screened funds and regular funds?

- More importantly, does ESG investing actually work, or do ESG investors sacrifice returns for their beliefs?

Stay tuned for upcoming posts where I address all of these.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.