You’re probably aware of the most common risks to a sound financial plan:

- Too much investment risk

- Too little savings

- Out of control debt

- Unexpected unemployment

- Disability

- Death

- Bad behavior (emotions lead to poor decisions)

- No financial plan

I’m sure I’ve left a couple off, but this pretty much covers the main contributors to a failed financial plan.

A Risk No One Wants To Talk About

There’s another risk that can be just as detrimental to a well constructed financial plan and I am willing to bet very few of you are thinking about it, let alone planning for it. I’ve had a few conversations with clients recently that have made me think about how I can help clients plan for, or at least research, their risk exposure.

What’s the risk?

Your parents. Are you prepared to help support your parents as they age?

For many families, money is still taboo. You don’t talk about how much money you make, how much you have, or don’t have, saved, and you definitely don’t share your money demons.

We better start talking about it though.

The upcoming holiday dinners and get-togethers (if you’re lucky to have them) may not be the proper setting, but sooner rather than later schedule some time with your parents to discuss how sound their financial plan is and whether or not they are at risk of needing your help in the future.

For many, there will be a surprise—your parents may not be in as good of shape as you think. It’s easy to create the appearance of financial security with the risk of struggle one emergency away or a hidden secret of not enough assets to last for current life expectancies.

It might be a tough conversation. It’ll be emotional. It’ll be scary.

After you process the emotions, which will be completely normal, you’ll be able to address the problem and plan for the possibility of needing to help your parents. Don’t delay the conversation—if the problem exists, you will find out eventually. If you wait to find out, it could blow up your own financial plan.

Some Statistics To Motivate You And Your Parents To Talk About Money:

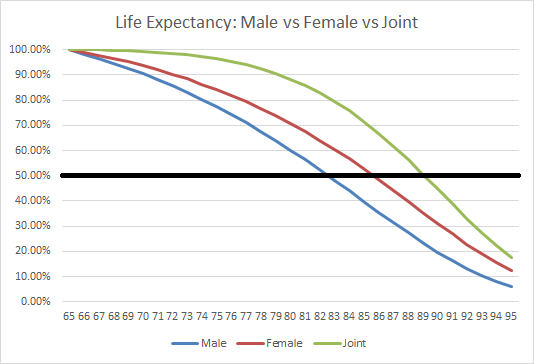

Life expectancy if age 65+: 83 for men and 85 for women (Source:CDC)

Likelihood of living beyond 90: Nerd’s Eye View–Life Expectancy Assumptions In Retirement Plans – Singles, Couples, And Survivors

Average 401(k) balance: Depending on age between $160k (50’s) and $180k (60’s) Investopedia (Yes, I know averages don’t paint the whole picture and there are other savings vehicles than 401(k)s, but nonetheless many of our parents do not have anything close to what will be needed to supplement their Social Security and pension if they’re lucky enough to have one.) (Source: Investopedia)

Average long term care expense: $8,000 a month for a private room in a nursing home (There are tons of options for professional care and they are all expensive.) (Source: Genworth)

Takeaway: People are living longer, many do not have enough money to supplement their fixed incomes, and it’s expensive to live long. If your parents don’t have enough money, it will become your (and potentially your sibling’s) responsibility to help them. How will you do that and continue with the plan you have set for your family?

One more thing to think about…I’ve only touched on the financial components of this risk. In addition to the additional financial stress you might bear, there will probably be emotional damage as well. Stress, resentment toward your parents, shame and embarrassment felt by your parents, and a host of other emotions I want you to be able to avoid should not be discounted.

What To Do

Have a conversation.

Ask your parents to be transparent and honest about their financial situation. From there the planning can begin.

This is a timebomb potentially ticking in your financial plan–talk to your parents so you can address it and beginning planning now.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

2 thoughts on “A Risk To Your Financial Plan You Aren’t Talking About”

Comments are closed.