“Personal Finance Is More Personal Than Finance” – Tim Maurer

A couple of weeks ago Morgan Housel joined The AGC™ for one of our weekly webinars. During the conversation, he shared what he called his “worst financial decision, yet his best money decision”. The short version of this decision is he and his wife aggressively paid off their mortgage. You might initially question why he might consider this his worst financial decision–paying off debt is typically a good financial goal and milestone. However, with mortgage rates at historical lows, spreadsheets and financial planning software would suggest investing the dollars that would be used for additional payments instead of paying off a mortgage; the long term expected return of a diversified portfolio is greater than current mortgage rates. Yes, I’m aware that past performance does not predict future returns, but even the most skeptical investor has to believe the long term return of a diversified portfolio should do better than the interest rate on a mortgage today.

Morgan admitted he knew from a financial standpoint, he would most likely be better off by keeping the mortgage and investing. He knows and understands the numbers behind the decision, but the peace of mind of not having a mortgage was more valuable than the additional dollars he could earn from investing–this is where personal finance becomes more personal than finance.

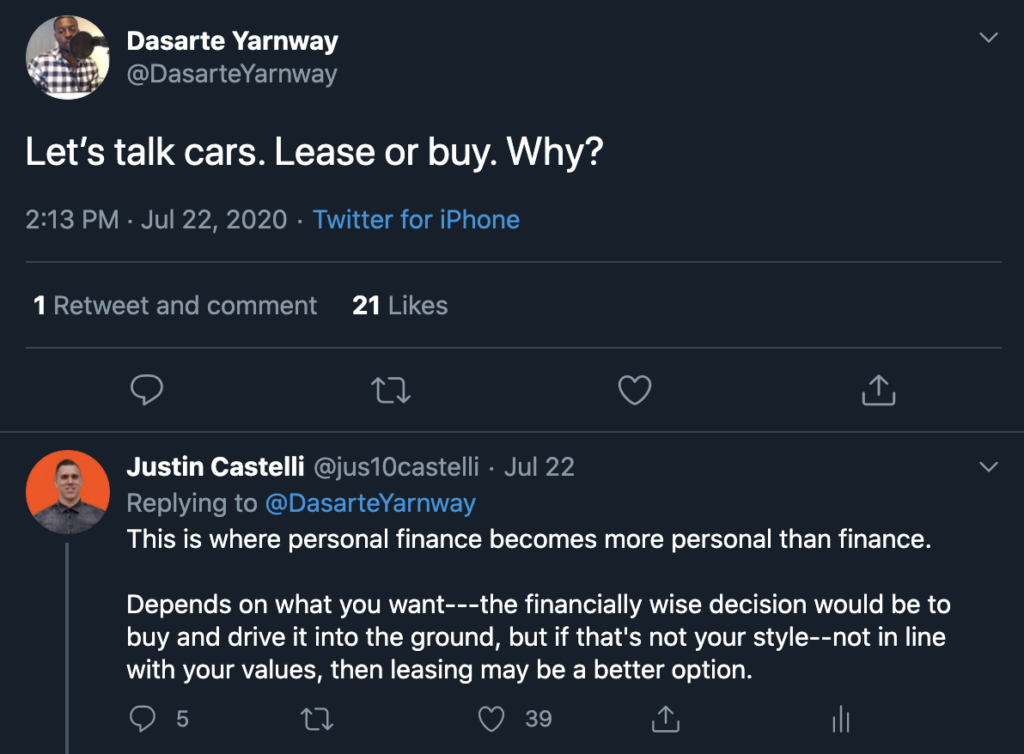

I was reminded of this last week when my friend Dasarte Yarnway posed a question on Twitter. He asked if it’s better to buy or lease a car.

My response was that it depends. The spreadsheet answer is you buy a car, pay it off, drive it for a long time, and have many years without a car payment. But, if you like to drive a new car and would be trading in every couple of years, despite knowing the numbers showing it’s not the right spreadsheet answer, then a lease might be a better option (there are other benefits to a lease as well). In this example, it is responsible to compare the options, look at the spreadsheets, understand the tradeoffs and sacrifices, and ultimately make the decision that aligns with your values and goals and execute that decision in the best “spreadsheet” way for that decision…i.e. chose the appropriate lease terms and model of car.

This can play out in almost all financial decisions: rent vs. buy a house, invest or pay down debt, experiences vs. things, stay in a high-paying crummy job or leave for a lower-paying fulfilling job, Roth vs. Traditional, etc. There’s no universally correct answer to these; it all depends on the individual. It depends on her financial situation, goals, priorities, preferences, and values. The right answer will be found by merging the spreadsheet and the personal.

One clarification: I’m not suggesting you should ignore the spreadsheet answer or that the spreadsheet answer may not be the “right” answer. My point is just because an option works out with better numbers doesn’t mean it’s the right answer for you.

More Than Spreadsheets

When reading about the basics of financial planning you will come across a number of rules of thumb: how many months of spending for your emergency fund, how much to spend on a house, what percentage of income to save for retirement, how much you should withdrawal from your retirement accounts, and the list goes on. On top of the rules of thumb, which are a good starting point, you will come across beliefs that are held to be truths because the spreadsheets say they are, like buying a car is better than leasing.

The truth is the “right” answer is usually part spreadsheet, part personal preference, and is right for you.

For the most part, financial advisors are not great at incorporating the personal component of financial planning; too many believe a financial plan is personal because it includes the client’s goals, but make recommendations that do not align with the client’s values and preferences–which are really what makes a plan unique and personal. A financial plan accompanied by recommendations that you never implement, or do not stick with, because they do not align with your values is worthless…even if it has the best spreadsheets to support it. On the flip side, a plan that still leads toward reaching your goals, albeit without accumulating as much as possible, while being in alignment with your values has a much higher chance of success–mainly because you’ll stick with it.

Now, to defend my profession a bit, we’ve been taught to follow textbooks and curriculum, become reliant on software to run scenarios and projections, told to always recommend the strategy that has the numbers to support it, and never really been taught or encouraged to develop the soft skills necessary to merge the spreadsheets with the personal side of planning. So, many advisors come by it honestly…

There’s Good News

I have good news.

Change is here and it’s becoming more popular—advisors are starting to put the personal in personal finance with Life planning (h/t George Kinder), AGILE planning (h/t Roger Whitney), and an overall increased awareness of the need to incorporate the values of clients in financial planning.

This will only lead to better relationships with financial advisors, more impactful planning, and more fulfilled lives.

I mentioned Morgan Housel earlier and he has a book coming out later this summer that I have no doubt will be phenomenal called the Psychology of Money, which you can pre-order here. Be sure to grab your copy!!

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining to your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

3 thoughts on “PERSONAL Finance”

Comments are closed.