Important: In today’s post we will be discussing specific stocks; the inclusion of these stocks in this post is NOT a recommendation to buy or sell. They are included only to illustrate the difficulty and risk of investing in IPOs.

https://twitter.com/ArchelBlunt/status/862400097732243456

They say buy what you know.

Well, the Millennials who followed that old adage and invested in Snap Inc., the parent company of Snapchat (ticker: SNAP), received a kick in the gut Wednesday afternoon. After the market closed, SNAP reported its first quarterly earnings as a publicly traded company, and to say Wall Street was not impressed is an understatement. The stock dropped 25% in after-hours trading thanks to slower than expected user growth and lower than expected revenues; while after-hours is not always indicative of the next day’s closing price, the response to SNAP is not encouraging. Thursday will probably not be a pleasant day for SNAP investors.

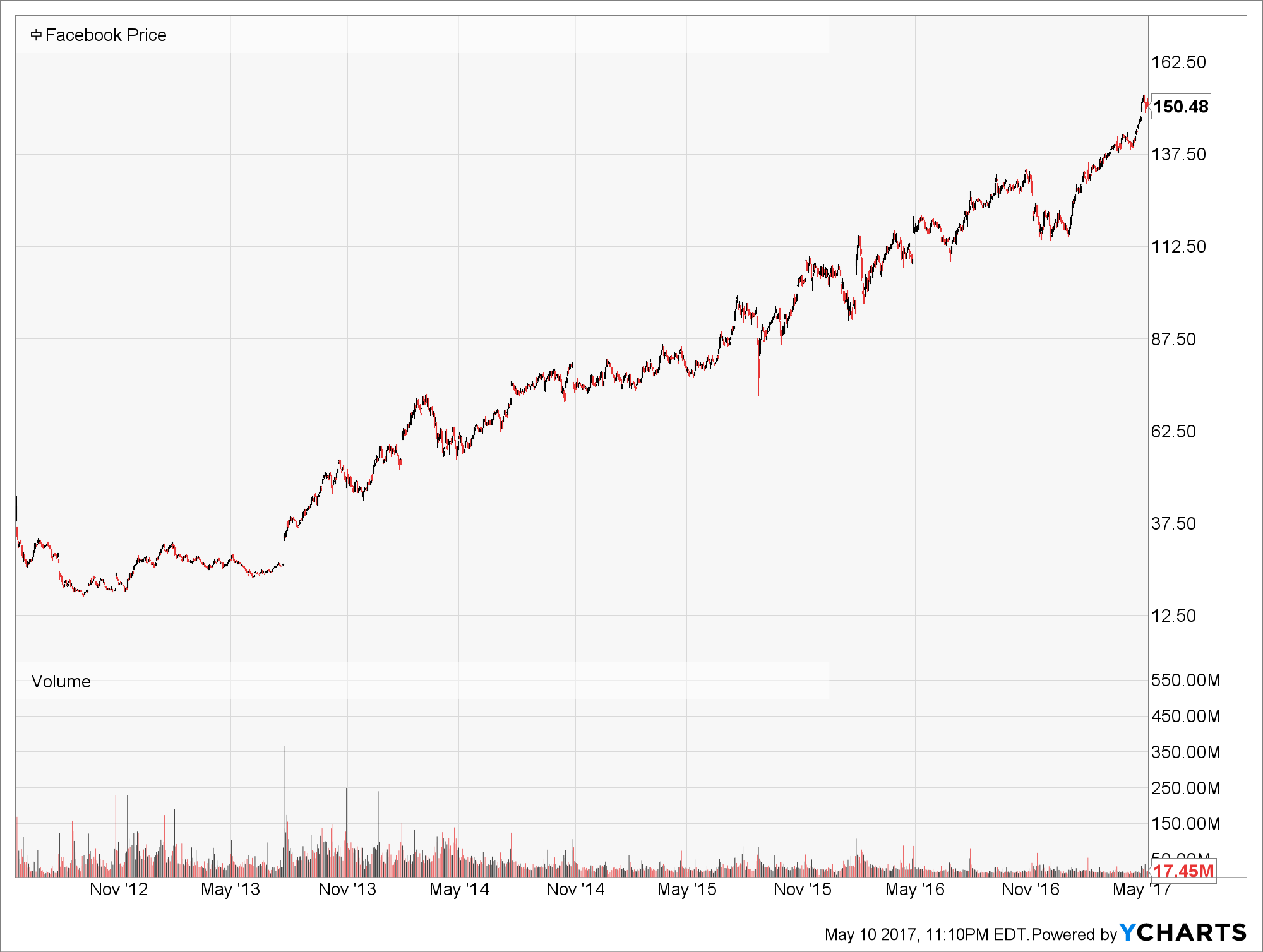

Investing in IPOs can be an exhilarating experience–one filled with hope of winning the lottery, but often filled with frustration. Rarely do IPOs, especially tech IPOs, go smoothly for investors. We need to look no further than tech giant Facebook (ticker:FB) to see how challenging participating early in a stock’s public trading can be. Below is the daily chart for FB during it’s first six months of trading…not a pretty chart. It’s hard to believe that a stock currently trading in the $150’s had such a rough start in it’s early days as a public company.

There were plenty of reasons to sell Facebook, and many investors did as it made its decline. When investing in a stock for speculation, or the excitement/hope of picking the winning lottery ticket, it is easy to be shaken out of the position. Those investors who were able to stick with FB and ignore the reasons to sell have been rewarded with a tremendous run, but it did not come easy–there were plenty of tests.

Not every IPO has a story like FB though. Twilio (ticker: TWLO), a recent tech IPO had a tremendous start to its publicly traded days, and then a surprise secondary offering sent the stock into a downward spiral. It’s almost the exact opposite of Facebook.

IPO’s in general are tricky to navigate in general, but tech IPO’s are on another level. When most tech companies begin trading publicly they are not profitable, have significant losses, and are trading on expectations of future growth. It’s very similar to NBA teams drafting college players after their freshman year.

Those players being drafted after one year of college basketball are being drafted because of their potential (speculation)–they have not played enough basketball to tell what their long term success as a NBA player will be. These players often go early in the draft and have a lot of excitement around them, much like the “unicorn” tech companies. But for every LeBron James, or Kyrie Irving (the Facebooks) their are dozens of Greg Odens, Andrew Bynum, Hasheem Thabeet, or Adam Morrisons (the Fitbits).

Only time will tell if SNAP if will be another LBJ, or another Greg Oden; it may have a tougher road ahead than Facebook did–mainly because Facebook is doing everything it can to put SNAP out of business. It’s probably going to be a bumpy ride for SNAP investors, and unfortunately, as with everything in investing, the long term outcome is unknown. Below is SNAP’s chart, and the candlestick for tomorrow might be another big red one. Stay tuned to see how the chart progresses…

For those rookie investors who just had their faces ripped off, as @ArchelBlunt so kindly reminded us, hopefully you did not invest a significant portion of your portfolio in SNAP and this is mostly a hit to your ego. Learn from this experience, re-evaluate your investment strategy, and the next time a hot stock comes up for it’s IPO remember this experience. The next one may end up being that lottery ticket, but it could also be a repeat of today.

More importantly, please do not let this experience sour you on investing! Investing is an important component to accumulating the wealth you will need for your long term goals–rather than consider the game rigged, re-evaluate your strategy, consult a financial advisor and develop a long term strategy that may, or may not include investing in stocks like SNAP.

Disclosure: Myself and/or clients of RL Wealth Management hold positions in Facebook and Twilio.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “Awww SNAP!”

Comments are closed.