By now, you’ve seen the action shot from last night’s Olympic 200m butterfly swim; you know, the one where Michael Phelps is mid stroke and zoned in looking down his lane. In the next lane Chad le Clos is looking at Phelps instead of focusing on his own race. This might be one of the best photos from this summer’s Olympics. If you have not seen the picture, check this article out to see it. (Note: I purposely picked this article so you can see the Michael Jordan crying meme that was created too). It’s no coincidence the swimmer who is focused on his own lane and his plan for the race won gold, and the swimmer preoccupied by the next lane placed fourth. By focusing on outside factors, factors outside of his control, le Clos sabotaged his chances at a repeat upset of Phelps.

Michael Phelps represents how we should act when it comes to our financial planning. Chad le Clos represents the way most of actually act when it come to our financial planning. Phelps had a plan for his race, he was not flashy as he prepared for the race, he trusted his plan, he followed his plan, and he was rewarded with a victory. Conversely, le Clos had a plan, he tried to be cute and get in Phelps’ head prior to the semifinal race, he didn’t trust his plan, he did not follow his plan, and he was rewarded with defeat. Why is it that so many of us have a hard time staying in our lane, especially when it come to our financial planning?

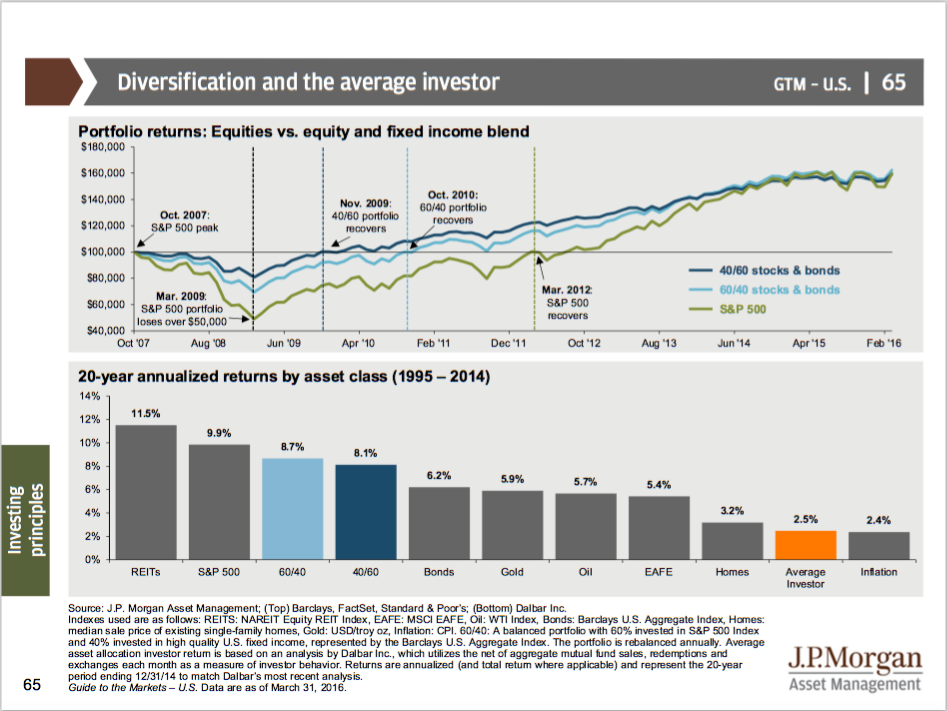

Many of us fail to stay in our lane because we are battling internal factors working against us. Genetically, humans are hardwired to make bad financial decisions. We allow emotions to lead us to make irrational decisions with our money. The stock market is down 30%, well I better sell everything I own. Or, this company doesn’t make a product and it doesn’t have any profits, but its stock is up 100% this year, I better load up on it. No one would admit to thinking this way, but the numbers show another story. Below is a slide from the second quarter J.P. Morgan Guide to the Markets showing the damage the average investor does to his portfolio. We end up focusing on things outside of our control like the Fed, short term market movements, government policy, Zika, etc., and the actions taken trying to address these concerns end up being counterproductive. Poor investment behavior leads to the average investor blowing his portfolio up and significantly underperforming a diversified buy-and-hold portfolio.

Source: J.P. Morgan 2nd Quarter Guide to the Markets

Not only do we have to fight our emotions when it comes to investing, but we also have to fight our desire to keep up with the Joneses. It is not uncommon for a client to ask me how they compare to “people like them”. I know deep down they are looking for confirmation they aren’t screwed–that there are others like them, but the desire to be compared to others highlights the human nature to want what others have. In financial planning, having what others have may not be necessary, or it may not be enough. The reality is there is no one else “like you”. Instead of being concerned on how we compare to others, we should shift our concerns to what we need to be doing to stay within our plan. Stay in your lane and focus on what your plan needs, and don’t get caught up looking over your shoulder.

In addition to the internal battle we face with our financial planning, there are also external factors we have to battle. Public enemy #1 for investors is the financial media. They may make it appear as if they have our best interest in mind, but they don’t. Instead, they amplify the importance of the factors outside of our control to draw us in. It is important to remember the financial media does not make any money by helping us–they make their money from advertising. And even if they were not motivated by ratings and clicks, it would still be impossible for them to be a reliable source to help with our planing because they do not know us. They do not know our personal situation, and therefore any “advice” rendered by the financial media is worthless–it becomes entertainment. Don’t let financial media pull your attention outside of your lane.

While financial media may be Public Enemy #1, social media is a close second. It’s hard not to peer over in another lane and give into trying to keep up with the Joneses. We live in a society where everything is documented on social media, and often times, a false reality is created. What you see on Facebook, Instagram, or Snapchat isn’t always true. Trying to match what social media “friends” are doing is a guarantee to derail the best laid plans.

Unfortunately, many individuals sabotage their chances at reaching their goals, just like Chad le Clos. In order to reach goals, it is imperative to have a plan–a roadmap–that will lead the way; to paraphrase Benjamin Franklin, failing to plan is planning to fail. But, having a solid plan is not good enough. Sticking to the plan, avoiding distractions, not giving into the temptation to deviate from the plan, and having someone, like a financial advisor to help stick to the plan will put you in the driver’s seat towards reaching your goals.

Develop a plan and stay in your lane.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.