Podcast: Play in new window | Download | Embed

Subscribe: RSS

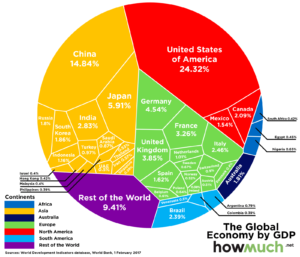

I’ve written about home country bias before, but I thought it would be great to revisit given the U.S. market’s outperformance of international markets for yet another year, well at least up until today. Over allocating to your home country is a common behavioral bias investors suffer from and for U.S. investors, it’s been a benefit over the last 10 years. But will it be for the next 10?

The answer is no one knows, but I still believe a GLOBALLY diversified portfolio is best for most investors and their financial plans. Be sure to listen to today’s Rundown, which I’ve pushed to the podcast and check out the graphs below that I reference.

Finally, this is not investment advice, so be sure to talk to your financial advisor to see where your home country bias lies and if you need to make any adjustments.

Visual Capitalist: The $74 Trillion Global Economy in One Chart

Past Posts:

Home Country Bias And Your Portfolio

Go ahead and subscribe to the RLS Wealth Management Rundown Flash Briefing.

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.