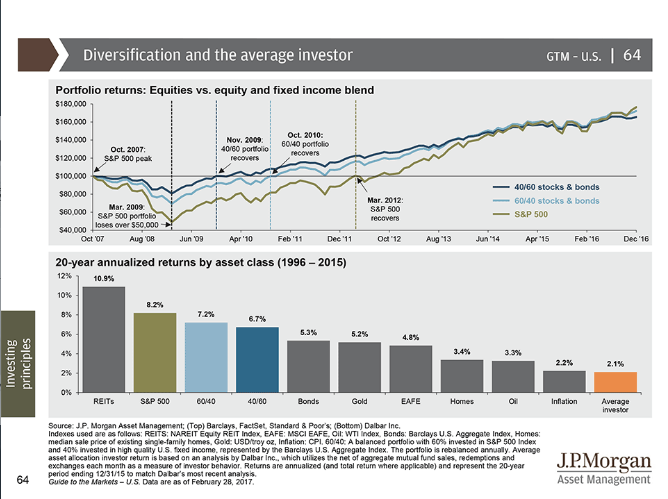

According to the famous Dalbar Study (see chart below), the average investor significantly underperforms the S&P 500, a balanced 60/40 portfolio and even a fairly conservative 40/60 portfolio. The causes for the underperformance are often self-inflicted, but well-intentioned. Nonetheless, they result in poor performance and a frustrating investment experience. My wife and I teach our boys they are responsible for their actions–there’s no blaming anyone else for what they do, and while I would also apply this to investing, it’s not totally your fault you’re a bad investor.

Behavioral Finance

In an effort to better understand why individuals make irrational financial and investment decisions, the academic world has created the field of behavioral finance. More and more advisors are spending time studying behavioral finance to gain a better understanding of how we can help our clients from continuing to make irrational decisions. Investors, really all humans, suffer from a number of behavioral biases leading to irrational decisions like chasing performance, selling investments in a panic, increasing investments during euphoric times and holding losing investments, while selling winners. All of these behaviors contribute to the wide margin seen in the chart above between the average investor and the various portfolios.

I want to take a moment and admit financial advisors/other investment professionals suffer from the same biases as the average investor–we are human beings, after all. For the most part, the studies have addressed how investors act with their own money, and advisors are less likely to fall victim to the same biases with their clients’ money–we view others money differently that our own. In addition, I’d like to believe the “good ones” understand these biases, have procedures in place and other protective measures to remove the emotions from managing their clients’ money–they may be blowing up their own portfolio, but that’s a different story.

The first step to correcting any problem, including poor investment behavior, is to identify the issue(s). So, let’s take a look at some of the most common behavior biases plaguing your portfolio.

Loss Aversion The pain of losing money hurts investors twice as much as the happiness experienced from a gain–simply put, we hate to lose more than we like to win. In an effort to avoid losses, investors sit in “safe” investments like cash, or they make investment decisions focusing only on potential losses, ignoring potential gains. In addition, the pain of loss can become so great investors finally give in and sell investments after large drawdowns, often at the bottom of the market. These attempts to avoid loss lead to a loss in purchasing power, missing opportunities of growth, realizing losses and missing out on market recoveries. If you are going to be an investor, you first have to accept risk. Risk is a part of the game, and it is because of risks we are compensated with long term gains. You can’t have growth without risk.

Confirmation Bias Investors are often blinded by information supporting their investment thesis; they’d believe they are right and focus on the information confirming their view. In doing this, they minimize and even neglect information contrary to their belief. Let’s take a look at the Snapchat fans whom invested in Snap, Inc. (ticker: SNAP) earlier this year. For many, this was their first experience investing in stocks, and to them, it was a no-brainer to invest in their favorite social media platform. They spent hours a day Snapping, as did their friends. Their love for the app kept them from paying attention to Facebook’s quest via Instagram to make Snapchat obsolete. Facebook added Stories, filters, and was increasing users, while Snapchat was seeing a decrease in users. These investors in SNAP learned a tough lesson about investing with blinders on; SNAP’s stock has been on a steady decline from a high of $27 to $14–who knows if it recovers. While it is important to have conviction in your investment, be sure you don’t focus on only the information supporting your view.

Disposition Bias Common sense would suggest investors sell their losers and hold their winners–this would require rational thinking, and as we’ve discussed already, investors are irrational and common sense is thrown out the window once emotions begin to take over. Disposition bias explains why investors sell winning investments, while holding onto the losers–the opposite of what they should do. It’s not surprising that disposition bias is closely tied to loss aversion; investors would rather hold onto a losing stock, than admit their error and realize the loss; that loss hurts too much. Instead, they sell their winners to lock in gains, while hoping the losing stocks recover. Studying momentum in a portfolio suggests investors holding out for a losing stock to recover will wait a long time; investments that have done well in the last 6 months tend to continue to do well for the next 6 months, while those that have done poorly in the last 6 months, tend to continue to do poorly over the next 6 months. The end result of the disposition bias is a portfolio of losers and frustration of seeing stocks sold for gains continuing to run. Double whammy!

Overconfidence

“Luck, pure luck. The sun even shines on a dog’s ass some days. Anybody can win the lottery.”

-Sidney Deane, White Men Can’t Jump

In order to be a successful investor, you’re going to need a little luck; it’s important not to mistake luck for skill. Investors, especially the fellas, exhibit overconfidence–believing they are a better investor than they really are. It’s impossible to time the market, or have insight on an investment no one else has (with the exception of inside information, and you shouldn’t be trading off that). Yet, investors give themselves too much credit for the investments that work in their favor. Overconfidence often leads to overtrading, which increases costs and potentially taxes, if in a taxable account. It also can lead to a lack of diversification. The market is humbling, and eventually good luck runs out–don’t let overconfidence put your portfolio in a bad position.

Recency Bias Investors have a tough time forgetting recent events in the market; suffering from recency bias keeps the Tech Bubble of 2000 and the Financial Crisis of 2008 on the minds of investors and their cash on the sidelines. Investors with a recency bias believe an event is more likely to happen again because it recently occurred. Unfortunately, there is no timeline for when an investor will shake their recency bias, and the more traumatic the event, the longer it will impact the investor. And even more unfortunate, recency bias can keep investors from participating in good markets–there are still a lot of investors sitting in cash fearing another 2008-like crash, and they’ve missed one of the strongest bull markets in history.

Herd Mentality Investors tend to be influenced by the pressure to conform with the majority–“If everyone’s investing in technology, they can’t all be wrong” was the theme in the late 90’s. This thinking resulted in a lot of investors losing when the Tech Bubble popped. Investors also suffer from severe FOMO; the recent explosion in the cryptocurrency market is a prime example. Investors with no understanding of the asset class are diving in because they don’t want to miss out on the gains early investors have experienced. The problem with following the herd is the herd is made up of “average investors”; they are not any smarter, don’t have better information, and suffer from the same biases–which means eventually the herd will be wrong, and everyone will get hurt. When the herd gets too big, it might be time to breakaway.

These are just a handful of biases investors battle; Google “behavioral finance” and you will find a laundry list of other biases investors suffer from. It’s nearly impossible to eliminate behavior biases–they are engrained in our DNA. However, there is a way to reduce their impact on your portfolio…

Working with a financial advisor to develop a financial plan and investment strategy can help alleviate the emotions and biases investors suffer when managing their own portfolio. Having a professional help with your portfolio management, a financial plan to guide long term decisions and guidance to ignore your biases can lead to a better investor experience and behavior; I’ve written about how the value of a financial advisor is more than just investment management–it’s helping clients improve their behavior, including managing their biases. You can check that post out here.

Don’t feel bad if you find yourself in the “average investor” category; until now, you most likely were not aware you were your portfolio’s worst enemy. But, now you know…what are you going to do about it?

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.

1 thought on “It’s Not (Totally) Your Fault You’re A Bad Investor”

Comments are closed.