I’m calling in a favor… My friend, Morgan Housel, has a book coming out in a few weeks and while he won’t publicly say it, it would be an amazing (and deserved) accomplishment for him to make the New York Times Bestseller list. I did not know this, but apparently, first week sales are make-or-break to top the list and…

Category: Investing

Lessons From Michael Jordan And The Last Dance–Presented By YCharts

For the last five Sundays at 9:00 PM EST, my family was glued to the TV. No iPad. No computers. No distractions. Just us and the 1990’s Bulls. It was a blast to relive the “old days” (I can’t believe I can actually say that) and for the boys to be able to see REAL basketball. It’s safe to say…

Berkshire’s Annual Letter: A Lesson In Setting Expectations

I’d be lying if I said I’ve grown up in the profession dissecting Warren Buffett’s annual letters to Berkshire shareholders. It wasn’t until I started writing this blog that I began reading his letters; I didn’t read to find investment tips. Instead, I began to read his letters to learn how to become a better communicator. Not only is Warren…

Bloomberg’s ETF IQ

I had the fortune of joining Eric Balchunas, Scarlet Fu, and Carolina Wilson on the set of Bloomberg’s ETF IQ. What an experience! It was a blast and hope this is the beginning of opportunities to hop in front of a real camera instead of my little old Canon. Thank you to Eric, Scarlet, and Carolina for being so welcoming…

Don’t Go Chasing Waterfalls

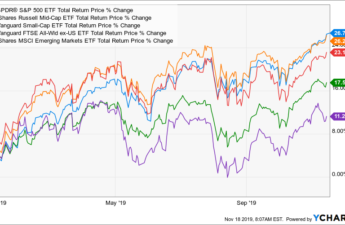

The Dow just broke through 28,000 (for now). The U.S. markets measured by large, mid, and small-cap stocks are all up over 20% in total return heading into the final few weeks of the year. Apparently, there are some “positive” conversations going on between the U.S. and China–at least that’s where we are in the cycle of good talks-bad…

Why I’m Letting My CIMA® Designation Lapse

Sunk Cost Fallacy– the idea that a company or organization is more likely to continue with a project if they have already invested a lot money, time, or effort in it, even when continuing is not the best thing to do. AKA Throwing good money after bad. -Cambridge Dictionary In March 2013 I earned my Certified Investment Management Analyst (CIMA®)…

Inside ETFs 2019 Recap

It’s Friday night, and I’m finally sitting down to write a recap of my time at the Inside ETFs Conference–it’s been a busy couple of days catching up. Earlier this week I spent a few days in Hollywood, Florida with some of the best and brightest in the business. It never ceases to amaze me the quality of people in…

Captain Jack

We all have our own stories of how John Bogle impacted our investment beliefs, careers, and lives. As I read all of the tributes, some of which I’ve included below, I realized I was robbed of the opportunity to get to know Bogle early in my career because of the limitations on the investments I could use by my employers–Vanguard…

And The Pendulum Swings

December 24th, 2018: Dow ends down 651.27 “Worse Christmas Eve In History” December 26th, 2018: Dow ends up 1,086.25 “Biggest Single-Day Point Gain In History” Dow up 1,000 points?!? Trade war over? Everyone cool with the Fed now? Political landscape no longer a dumpster fire? Oh, nothing substantial has changed since Christmas Eve? Hmmm… — Justin Castelli (@jus10castelli) December 26, 2018…

Why Financial Advisors Love Data

Have you ever wondered why financial advisors quote statistics, charts, and graphs? The data contained in statistics, charts, and graphs used by advisors often backs up the plans created for our clients; it provides the evidence needed to help clients (or readers) stay in the game when emotions begin to cloud their decisions. Be careful though, the data can also…