Today, Josh Brown gave individual investors another reason to skip stock picking and stick with boring, low-cost, and globally diversified investment portfolios.

For $FB holders to make as $AMZN holders have made since the IPO, it would have to become a $36.5 trillion company!https://t.co/jGHP5n52Wv

— Downtown Josh Brown (@ReformedBroker) March 30, 2017

Stock picking is no easy task, and individual investors have an uphill battle when it comes to consistently picking individual stocks for their investment portfolios. In theory, investors should make money hand over fist; just ask anyone how to make money in stocks, and they’ll probably say something to the extent of, “buy low, sell high”…pretty simple, right?

If only it were that easy!

When picking individual stocks, the individual investor not only has to know when to buy the stock, but they must also battle the psychology of investing while holding the stock. Rarely, does a stock move in a straight line up, which means investors have to sort through news, tweets, earnings and any other information that may impact a stock in the short term and decide whether or not to act. Humans are hardwired to make bad investment decisions which makes holding a stock for the long-term difficult, and IF an investor is able to control their emotions during the ebbs and flows of the stock price, they still need to know when to sell.

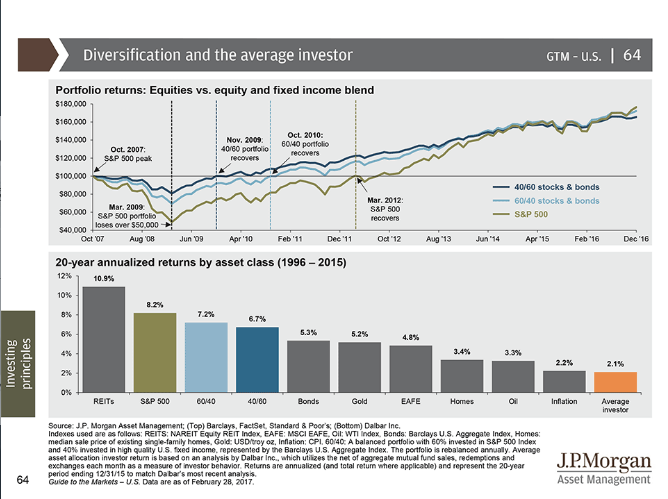

The act of selling is harder than knowing when to buy a stock. If the stock price is falling, investors often hold on hoping the price will come back; we don’t like to admit when we are wrong. If the price is going up, it’s hard to sell because of the fear of missing more gains. Yes, investors can implement rules for their investment strategy, but when the time comes to follow the rules, it’s a different story–emotions cloud investor judgement. The chart below, which is one of my all-time favorites, shows the impact of psychology on the average investor’s performance.

And it’s not just individual investors who struggle; I highlighted some professional blunders in a recent post you can read here.

Going back to the tweet above, and Josh’s post below, it is highly unlikely that Facebook will become a $36.5 trillion company. Which means, investors in Facebook don’t stand a chance of catching the growth Amazon investors experienced. Note: Yes it would be possible to trade in-and-out of a position to potentially enhance returns, but it could also detract from the returns. I’d rather focus on those investors willing and able to stick with the stock for the long-term. Don’t get me wrong, if you invested in Facebook at the IPO and stayed with it, you’d have a nice gain in your account. But, if the opportunity for individual investors to be rewarded for investing early in companies is diminishing, then is it worth it when you combine this with the other factors discussed above?

Take a few minutes to hop over to the Reformed Broker to read what Josh Brown has to say–his posts are always fun to read. I’d also encourage you take a few more minutes and take a look at the presentation referenced on the Reformed Broker–I’ve included a link to Michael Mauboussin’s slides.

Don’t worry, I’ll continue to present evidence to support the use of boring, low-cost, and globally diversified portfolios for individual investors!

Additional Readings:

The Reformed Broker: The Gains No Longer Available To You

Credit Suisse: The Incredible Shrinking Universe Of Stocks

Disclaimer: Nothing on this blog should be considered advice, or recommendations. If you have questions pertaining your individual situation you should consult your financial advisor. For all of the disclaimers, please see my disclaimers page.